How pillar 3a can free self-employed persons from financial worries

Are you an entrepreneur? You are independent and actually just want to take care of your business? As if one didn't have enough to do already, there is also the issue of precaution.

Shall one make provisions at all as an entrepreneur? And if so, with the Pension Fund or with the Large pillar 3a? This article is meant to take you by the hand and show you how the Pillar 3a frees self-employed persons from financial worries can.

Today you will learn how to work with a Combination of pension fund and pillar 3a make provisions for the future. The focus of this article is on pillar 3a.

Pillar 3a for Self-employed? That's it!

Any other questions or constructive feedback? We look forward to an exchange in the comments!

This article was written in collaboration with Zak of Bank Cler. In addition to other providers, Zak Vorsorge offers a suitable solution for your pension provision, which is why we will go over the offer again and again in this post.

Pension provision for self-employed persons in Switzerland

Pension provision for the self-employed in Switzerland can basically be solved in two ways:

- Either you join a Pension Fund and optionally select the small pillar 3a (which in 2021 is currently CHF 6'883 are - like normal employees) or

- You're closing no pension fund but instead select the large pillar 3a (which is still a whole CHF 34,416 in 2021).

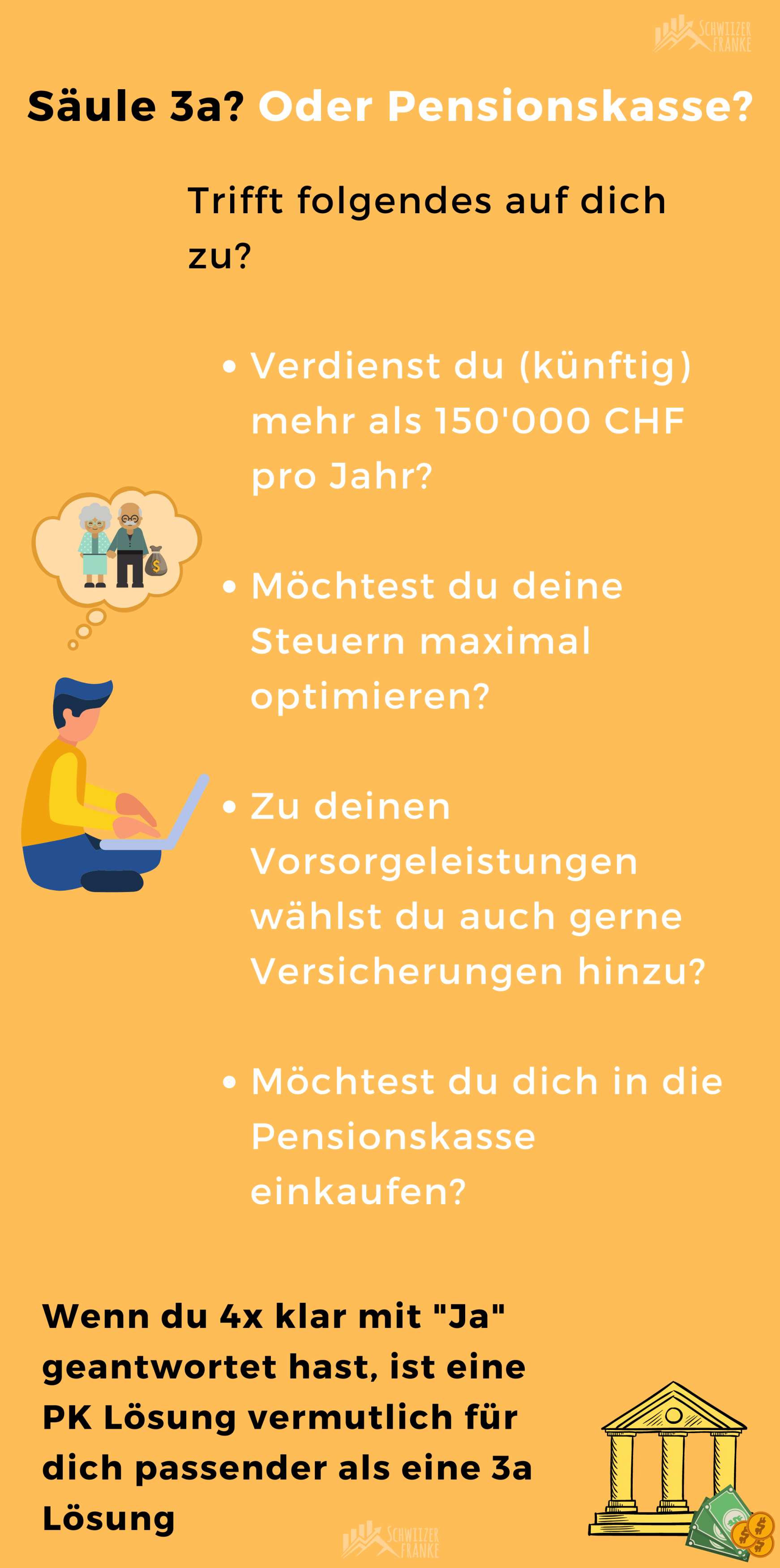

Pillar 3a in combination with a pension fund

This paper will specifically address the Provision for the self-employed by which Pillar 3a in combination with a pension fund dedicate. Because Pension funds (PK for short) Solutions offer just For large incomes of more than CHF 150,000, a enormous tax advantage. If you opt for the pension fund, you also have the advantage of a small pillar 3a, i.e. up to a maximum of CHF 6,883. You can find out more about this combination of PF and small 3a today.

By the way, it should be said first: If you become self-employed, you can either found a partnership (e.g. sole proprietorship) or a corporation (e.g. AG or GmbH). In a corporation you are a normal employee of your own company, even if you are the founder, owner or sole proprietor. If you set up a partnership, however, you have considerably more scope and flexibility to act with your pension assets.

Suppose you join a Pension Fund and select the small pillar 3a in addition. Above, you have already learned that in 2021 this will be up to CHF 6'883 are. The primary advantages for you are as follows:

- Yours Payments into the pillar 3a are from the tax exempt. You can therefore deduct it from your taxable income. This is one of the strongest arguments surrounding the question of how Pillar 3a can help self-employed people. Secure in the long term can.

- In the meantime, there are very exciting 3a solutions, where your capital does not lie dormant in an interest account, but rather actively invested in stocks can be achieved. Annual returns of 3-7% are very realistic in the long term. Zak for example, offers precisely such a pension plan with securities.

- Self-employed persons are subject to a Liability risk with private assets. Statistically, some self-employed activities don't quite work out financially. But if you have paid your money into pillar 3a or PK, it's not a problem. protected from potential personal insolvency! So even if your startup fails, you won't be empty-handed in your old age.

- Is the dream of owning your own home always on your mind? With pillar 3a, you can save for your Financing home ownership. Depending on the provider, you can pledge your 3rd pillar or make an advance withdrawal from pillar 3a.

- You decide, what to do with your money in pillar 3a made Sync and corrections by n17t01. Because you choose your 3a provider and with Zak you even have the possibility to co-determine the investment strategy. Are you more risk averse? No problem, Zak - – Sustainable income has a lower equity exposure than, say Zak - Sustainable growth.

Pension provision with Zak 3a

Does pillar 3a make sense at all for the self-employed?

Cross my heart - most self-employed people have little time. Furthermore, many of them see their job as their best provision for retirement. Silicon Valley entrepreneurs lead the way: A few years of hard work, the startup "takes off" and financial worries are gone forever.

But here you should be honest with yourself - how many entrepreneurs become so financially successful? They are few among thousands. Self-employed people as well as "normal" employees are human beings and they too do not like to deal with old age, the time when the money does not come as regularly and maybe even an illness that financial worries raises.

But fears are not needed at all in order for the Pension provision with pillar 3a for the self-employed motivate. For many self-employed people, freedom is a high value. Financial freedom or at least to look at this issue without worry is a point that is desirable for everyone. With a Investment in your Pillar 3a you can achieve this wonderfully. There is even a post that shows you how to Become a millionaire with pillar 3a can.

More and more people understand the Potential of responsibility over one's own finances. What used to be often non-transparent and expensive is now becoming cheaper and, above all, more transparent. Another exciting point here is the Sustainability the investment. While in the past the opinion "shares are bad" was widespread in many circles, today more and more people know better.

It is precisely through transparency in terms of sustainability in investments (for example through ESG ratings), today you can even Targeted environmentally friendly investment. Controversial companies (such as arms or tobacco manufacturers) are excluded, companies with increased CO₂ emissions are weighted less and environmentally friendly companies are weighted more heavily. This way, you don't have to worry about sustainability if pillar 3a is supposed to cover self-employed people.

Whoever enters the Factsheet of the Zak Pension Strategies If you take a look, you will see that investment decisions are not only based on traditional financial ratios. Also Environmental and social criteria are taken into account.

On Zak's blog you will find more information about the implementation of the sustainability criteria. All investment strategies were awarded the AA rating according to MSCI ESG Fund Rating.

Sustainable provision with Zak

How do you proceed concretely when you want to Pillar 3a pension with securities and, if necessary, even sustainably? There are several providers who offer themselves here and attractive, digital offers offer.

In the area of pension provision, Bank Cler offers an Investment in securities with up to 90% and has also included sustainable funds for these strategies. Such a high equity quota in pillar 3a was unthinkable a few years ago!

The Zak Vorsorge can be conveniently installed in the Zak Store and from there you can invest your pension assets directly and easily.

Pension provision with Zak 3a

Conclusion: Can pillar 3a provide sufficient financial security for self-employed persons?

As a brief conclusion to the question of how pillar 3a can protect self-employed persons from financial worries, it can be summarised: The Pillar 3a lowers your taxes, protects the invested part of your Assets against private insolvency, gives the possibility Financing home ownership and your Compensate pension. Does that sound good? Then get advice from a provider that suits you.

This article is not investment advice, but is intended to show a way of providing for yourself as a self-employed person.

You want to know more about the Provision for the self-employed or receive more in-depth information on Zak pension plans?

Feel free to leave a comment or share your experiences on the topics!

Transparency Note: The article "How Pillar 3a can free self-employed people from financial worries" was created in collaboration with Zak of Bank Cler. The content and presentation have of course been created and designed freely and independently by Schwiizerfranke.

2 Responses

Small correction: you cannot deduct the CHF 6,883 from your taxes, but from your taxable income.

Furthermore, the BVG only insures salaries up to CHF 60,945. A non-compulsory solution would therefore have to be sought in order to insure CHF 150,000.

Here, the costs of a BVG solution are much higher than with the large pillar 3a. Plus, you can't invest as aggressively as you might like.

Thank you for your comment regarding taxable income!

Correct, the BVG compulsory insurance starts at CHF 21,510 and extends up to the upper limit of CHF 60,945. If you choose a PF solution and want to insure above the upper limit, you choose a non-compulsory solution.

In the linked article from VZ, it is shown that for high incomes, the tax savings including costs with this solution are very attractive. The costs you mentioned would therefore be exciting to consider in combination with the tax savings overall.

Generally speaking, it can be said that the PF offers far fewer opportunities for individual adjustment of the investment strategy compared with Pillar 3a.