NEON Bank experience 2026

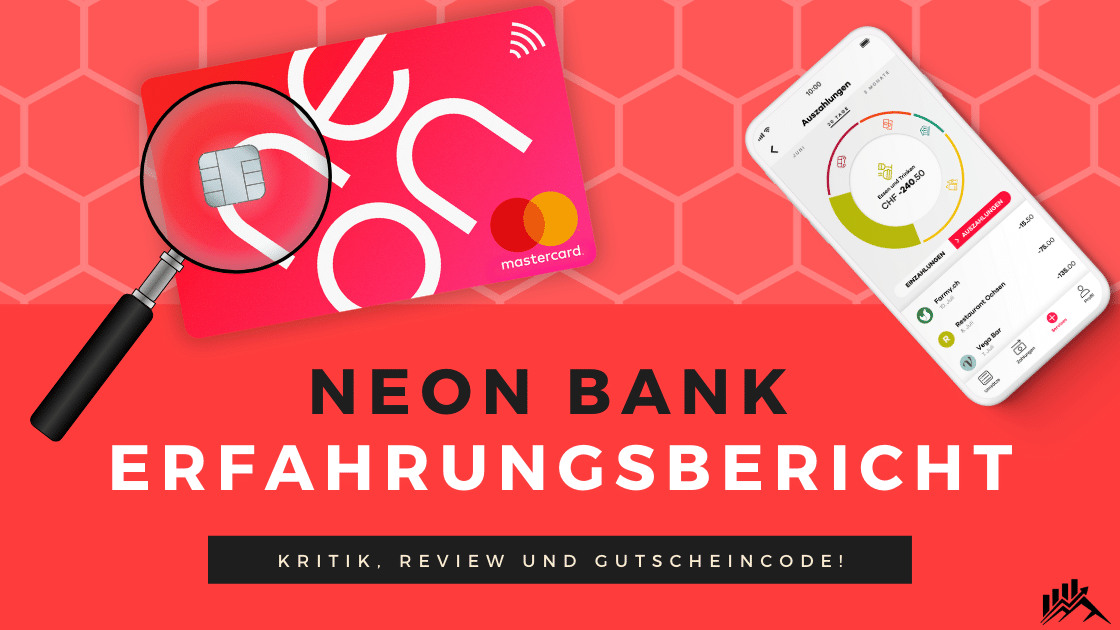

We tested Neon Bank and the Neon app for you, gathered our experiences and wrote a Neon review for you. Of course, we give you all the necessary tips and a voucher code. We show you the advantages and disadvantages and go into detail about how Twint is supported.

Our Neon Bank experience can certainly help you decide whether Neon suits you and whether you should use it as a salary account, for example.

Neon voucher code: 2026 Referral code

NEW: Secure now CHF 100 trading credit as a gift! 🎉

Open your Neon account and enter the code TRADE when registering. You will receive CHF 100 trading credit, which you can use in your first 3 trades within the first 2 months. A perfect start for your investments - get started now!

4,9

🏆 Most affordable bank 2026 – Neon has done it again!

Table of contents

What is the Neon Bank and what is on offer?

The Neon Bank is the first independent account app available in Switzerland. Independent means not being directly involved with big banks or other institutions.

With Neon, you are not tied to a house bank or other institutions with high fees. You can clean up your wallet and, in extreme cases, only use the Mastercard of neon with you.

While Neon offers a tidy banking solution, "Hypi" is working in the background. The Hypothekarbank Lenzburg ensures secure and reliable banking with Swiss deposit protection.</span

For several years, the founding team has made it their mission to create the simplest account in Switzerland. Intuitive operation and yet maximum certainty are right up there. Paperless, a Account opening in 10 minutes and other features are assured for a positive Neon Bank experience.

Outstanding favourable conditions at home and abroad are also key. In 2023, the Neon Investment function was added, but more on that in a moment.

Neon Bank advantages

- NEW: The Savings plan templates from neon make portfolio construction particularly easy

- New: Four flexible account plans (free, plus, global and metal) for individual needs

- NEW: Neon 3a is here! Since autumn 2025, there has been an integrated 3a in the app. Here you can find our Neon Column 3a Experience Report.

- Finally, Neon Duo is the Neon partner account available!

- 0.35% Neon Exchange rate fees abroad for card payments!

- Fees for Cash withdrawals about CHF 2.50 per reference. Exceptions for free withdrawals.

- You can now start with Invest neon!

- With Neon Spaces savings pots or sub-accounts are available at Neon!

- Credit Interest: There is currently no interest on the savings account at Neon.

- Cheapest international transfersthanks to the cooperation with Wise.

- Pin management in the Neon App. Never forget the pin again!

- support of eBill

- Neon youth account: Opening already from 15 years possible!

- Free account management

- One card for everything (Mastercard)

- Swiss deposit insurance of your assets up to CHF 100,000 via Hypothekarbank Lenzburg

- Paperless environmentally friendly Processing

- Photo Onboarding, so a Video Ident account opening procedure

- Transparent and favorable Fees

- Free of charge, clearly arranged Neon Bank App

- Link and transfer by Twint is possible via prepaid TWINT

- Integration of Google Pay, Samsung Pay and also Apple Pay!

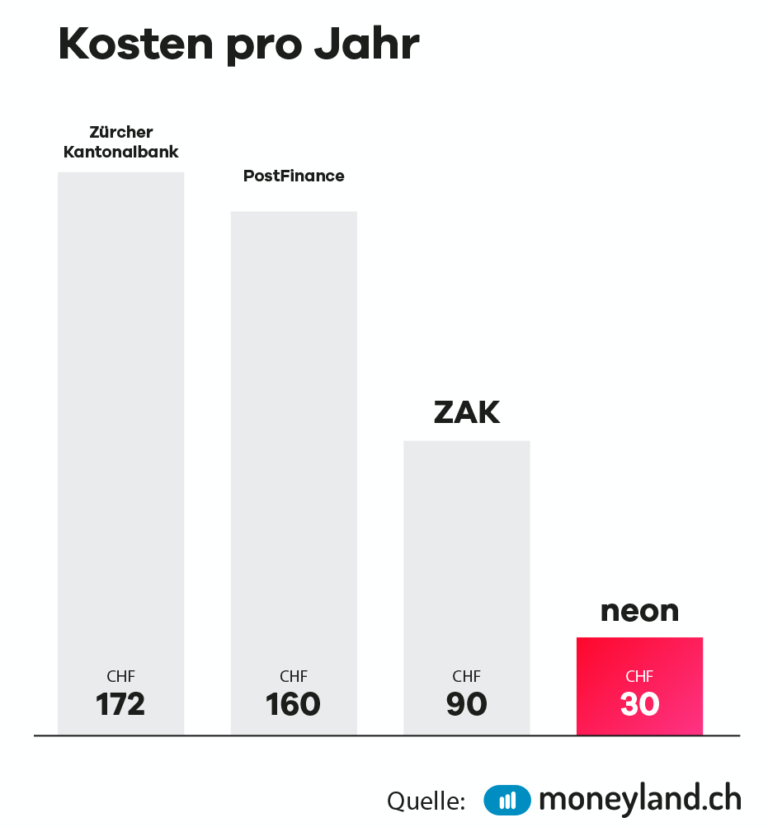

Neon bank charges: Cheapest bank in Switzerland?

Neon bank charges: Cheapest bank in Switzerland?

Despite low fees, Neon remains unrivalled in terms of affordability: independent tests confirm that Neon is the most cost-effective banking solution in Switzerland for most user profiles.

Important fee changes since May 2025:

- Neon free:

- Card payments abroad/foreign currency: 0.35% Exchange rate premium

- Cash withdrawals in Switzerland: CHF 2.50 per subscription (free of charge at Coop, Lidl, Sonect)

- First card and replacement card cost CHF 20 (new since October 2025 )

- No monthly or annual basic fees

- Neon plus, global, metalStaggered monthly fees with extended services and reduced or cancelled individual fees

These adjustments do not change the overall picture: Neon remains well below traditional banks in terms of price and continues to offer excellent value for money.

NEW: Secure now CHF 100 trading credit as a gift! 🎉

Open your Neon account and enter the Neon Bank code when registering TRADE in. You will receive CHF 100 trading creditwhich you can use in your first 3 trades within the first 2 months. A perfect start for your investments - start now!

Neon Bank Disadvantages

- ❌ Physical card subject to a charge (CHF 20)

- ❌ No UBS-TWINT compatibility for new cards

- ❌ Only 2 free cash withdrawals/month (Free)

This is less important to young people, but sometimes it is to older people: As an online bank, Neon does not have any branches. This saves enormous costs, which can then be invested in good telephone support. We have never had to wait on hold for support at Neon! This point is therefore only a limited criticism in the Neon Bank Review.

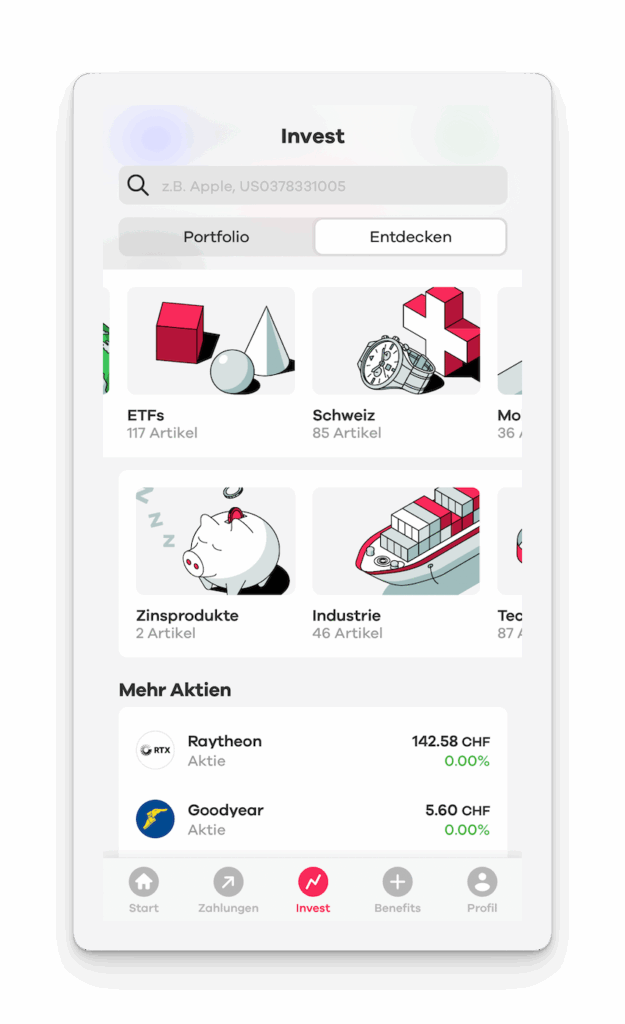

Invest with Neon

You have been able to invest directly within the Neon app via Neon Invest since 2023.

The securities are traded on the Berne Stock Exchange at very customer-friendly conditions. Because there are no flat fees, you can also invest small amounts with Neon.

Here are all the Neon Investment advantages at a glance:

- No ongoing Neon custody fee

- Neon ETF savings plan: New function since May 2024 for automatic monthly ETF savings plans

- No fees for currency exchange

- Swiss securities: flat transaction fee of 0.5% of the buy / sell price

- International securities: flat transaction fee of 1.0% of the buy / sell price

- A growing selection of shares and ETFs

- Currently still limited selection of securities (to be expanded soon)

- Currently still limited choice of order types (a limit order is to be added soon)

- No web solution, only mobile app.

Neon Duo: The Neon partner account is here!

Since May 2025 is that Neon partner account even more attractive: It is now Can be combined with all Neon plans (free, plus, global, metal) and the advantages of your chosen plan also apply to your Neon Duo card.

Everything you need to know about the Neon joint account at a glance:

- Two Neon accounts as a basis (open with voucher code)

- Own IBAN and separate cards for the joint account

- Clear presentation and intelligent statistics in the app

- Yours personal Accounts stay unchanged exist

The additional card costs CHF 3 per month per person - fair compared to other providers with hidden costs. The Neon joint account saves you money compared to expensive major bank cards, especially when travelling abroad.

Find out more in our Partner account comparison.

Neon voucher code: 2026 Referral code

NEW: Secure now CHF 100 trading credit as a gift! 🎉

Open your Neon account and enter the code TRADE when registering. You will receive CHF 100 trading credit, which you can use in your first 3 trades within the first 2 months. A perfect start for your investments - get started now!

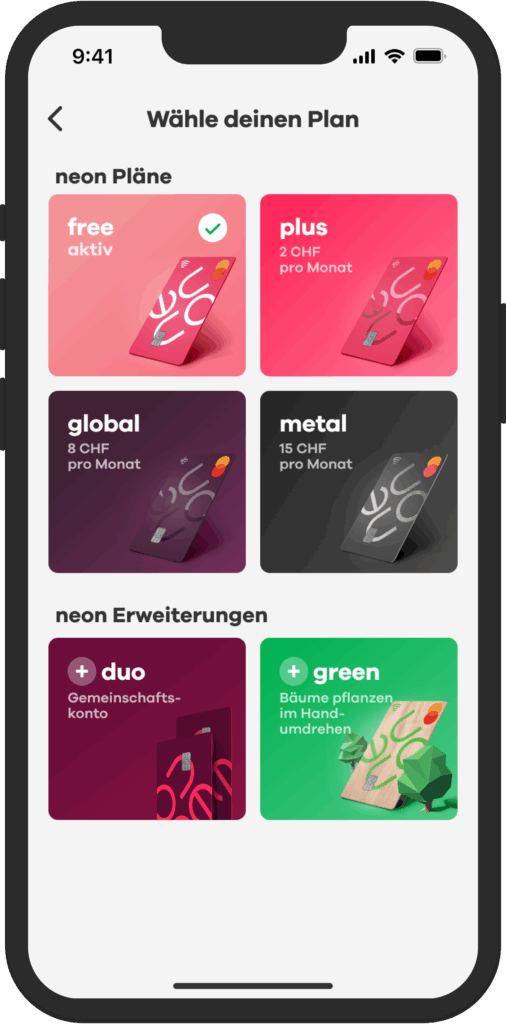

A comparison of the four Neon plans: is a paid plan worthwhile?

An honest analysis of the Neon plans:

Neon free (0 CHF):

- Ideal for whom: Most private users with average usage behaviour

- Fees: 0.35% Exchange rate surcharge for foreign payments, CHF 2.50 per cash withdrawal CH, 1.5% cash withdrawal abroad

- Example of costs: With CHF 2,000 foreign payments/year (CHF 7) and 12 cash withdrawals in Switzerland (CHF 30), the annual costs are approx. CHF 37

Neon plus (CHF 20/year with annual subscription):

- Worth it: Regular foreign payments or more than 1 cash withdrawal per month

- Fees: 0% Exchange rate surcharge, 2 free cash withdrawals/month CH, 1.0% Cash withdrawals abroad

- Example of costs: With CHF 2,000 foreign payments/year and 24 cash withdrawals, you save CHF 47 compared to free - at a cost of just CHF 20 with an annual subscription, that's a saving of CHF 27

Neon global (CHF 80/year with annual subscription):

- Pays off for: Frequent travellers with higher international requirements

- Fees: 0% Exchange rate surcharge, 3 free cash withdrawals/month CH, 0.5% Cash withdrawals abroad

- Example of costs: With 4 trips abroad with CHF 500 cash withdrawals each (CHF 10 savings compared to "plus") and additional cash withdrawals in Switzerland (CHF 30 savings), as well as travel insurance included (approx. CHF 100 value), the annual subscription for CHF 80 pays off.

Neon metal (CHF 150/year with annual subscription):

- Worthwhile for: Frequent trips abroad with cash requirements and expensive mobile devices

- Fees: 0% Exchange rate surcharge, 5 free cash withdrawals/month CH, 0% Cash withdrawals abroad

- Example of costs: For 6 trips abroad with CHF 1,000 cash withdrawals each (CHF 60 savings) plus mobile phone insurance (worth approx. CHF 120/year), the annual subscription pays off for CHF 150

Conclusion:

- Neon free: Ideal for users with few foreign transactions and infrequent cash requirements

- Neon plus (CHF 20/year): Worthwhile from moderate foreign payments - with 17% savings on the annual subscription a clear upgrade

- Neon global (CHF 80/year): For travellers with stays abroad and an appreciation of insurance cover

- Neon metal (CHF 150/year): For frequent travellers with increased cash requirements abroad and expensive smartphones

All plans can be combined with Neon Green (environmental protection) and Neon Duo (joint account) for CHF 3/month per person.

Bank account comparison calculator

Neon Bank experience and review

There are quite a few players in the Swiss banking world. Old favourites such as UBS, Postfinance and the like are now also digital, but high fees put some customers off.

Neon Free does not (yet) offer such a large feature catalogue as digital providers abroad. Share trading and the like are not yet possible with Neon, but is that necessary?

In true Swiss fashion, Neon doesn't promise too much or too soon. On their website they show transparentwhat is coming soon and do not promise the impossible here.

As far as the Neon fees are concerned, the bank in Switzerland has absolutely top conditions! For international transfers Neon cooperates with Wise, a provider for international payments. This makes it possible to transfer money to countless countries and currencies at unbeatable conditions within a very short time. This works intuitively within the Neon app, if you tap there on foreign payment.

When it comes to the usability of the app, we give the Neon Schweiz app full marks. There is really nothing to criticise here.

A Neon Bank Partner Account (if two people want to use the same account) is not yet offered, but with the free account management you can also open two accounts with confidence.

Oh, and by the way: If you really want to master your finances, you should take a look at the 3 Accounts View Model. How you can implement this with neon, for example, you will learn in the Spartipps Switzerland Articles.

Neon voucher code: 2026 Referral code

NEW: Secure now CHF 100 trading credit as a gift! 🎉

Open your Neon account and enter the code TRADE when registering. You will receive CHF 100 trading credit, which you can use in your first 3 trades within the first 2 months. A perfect start for your investments - get started now!

Video: Neon App Tutorial

Outlook: What Neon is currently working on

- Further functions for Neon Invest: Further order types, AI functions, further shares and ETFs, ...

- Continue to give everything to best and cheapest Swiss bank on the market!

Conclusion of our Neon Free experience

With the May 2025 update, the Neon Bank Switzerland has made its offering much more flexible. The four plans (free, plus, global and metal) now cover a wide range of needs - from cost-conscious users to premium customers who want comprehensive insurance benefits.

The Neon free plan remains without a monthly basic fee, with minor adjustments for foreign payments (0.35% exchange rate surcharge) and cash withdrawals (CHF 2.50, free at Coop, Lidl, Sonect). Since autumn 2025, the new card unfortunately costs CHF 20 and TWINT is only available with prepaid due to the new Debit Mastercard.

Positive: The extensions Neon Green (sustainability) and Neon Duo (partner account) can now be combined with all plans - so you can configure your banking according to your wishes.

Our Neon rating continues to be very positive. The comments shared in the Neon experiences from the community have been consistently recommendable for years and confirm this impression.

With the voucher code "TRADE" there is CHF 100 trading credit for your first 3 trades in the first 2 months at Neon Invest - a perfect start for your investments!

FAQ

Does Neon offer Apple Pay?

If you want to use Apple Pay with Neon, you can do so conveniently. To do so, link your Neon card in your settings under Apple Pay as a payment method. You can then use Apple Pay with Neon Free.

Does Neon Bank offer Twint?

How can I deposit money at Neon Bank?

Anyone who wants to deposit money at Neon Bank should do so digitally. Neon Bank is an online bank and does not have any branches. Therefore, use a bank transfer or alternatively the deposit via payment slip at the post office (fees may apply here).

How can I withdraw money from Neon Bank?

If you want to withdraw money with Neon Bank, you can do so twice a month free of charge at third-party ATMs with the Neon Free card. In the Neon app via Sonect, you can also find additional options for withdrawing cash free of charge as often as you like. You can also withdraw money free of charge at Lidl stores with the Neon Bank.

Neon credit card experience abroad?

Neon works with Mastercard as payment service provider. Since Mastercard offers a very large international network, we were able to gain experience with our Neon credit card in many countries. There were almost never problems. Nevertheless, it is advisable to carry cash and a Visa credit card (e.g. Zak) when traveling extensively.

Can I use Neon as a payroll account?

Of course you can use Neon as a payroll account. The best way to do this is to move money from the incoming account where your salary arrives to a sub-account ("Neon Spaces"). This way there is less money exposed on your main account. If your total assets in the Neon salary account become too large, consider withdrawing a portion of them. This always makes sense from CHF 100,000 at the latest.

Do Neon have economy pots?

Yes, at Neon the savings pots are called Spaces.

Tip: Use the Neon savings pots (Spaces) for even better interest rates.

Neon Bank Alternative

Here you will find a big comparison of online banks for Switzerland.

About the author

Eric is the founder of Schwiizerfranke.com and certified IAF wealth advisor. Since 2019, he has been helping Swiss citizens to organise their finances comprehensibly, independently and efficiently.

📌 Note: This article is for information purposes only and does not constitute personalised investment advice.