Frankly experience report: Review of the ZKB pension solution 2024

The ZKB is 150 years old, but has been showing since 2020 with Frankly that it has not slept through digitalisation. Frankly has now acquired over 95,000 customers and by 2024 is already managing more than 2.5 billion Swiss francs.

What exactly is the Frankly ZKB app all about and how is it used in the Comparison with other We discuss the best pension solution here. In addition, you can read in our Frankly experience report why a 3a custody account is superior to a 3a account and how you can simply optimise your pension provision!

If you want to make your own Frankly test directly, use our Voucherto receive additional starting credit.

What exactly is the Frankly 3a App from ZKB?

It is no longer a secret that there are quasi no interest more exists, Inflation However, it is. This is not a good starting position for free assets, such as pension assets in interest accounts.

The traditional company ZKB has recognized this and is countering it with the Frankly 3a app. Within a few minutes, a Frankly account can be opened, a Investment strategy and get started on your 3a retirement savings. Instead of hoping for interest, Frankly provides you with a customizable way to invest in Securities (shares etc.). This way you can increase your pension at balanced Build risk very well in the long term.

Find out what the Frankly experience looks like in detail below!

Advantages of Frankly

- Low fees: Frankly fees are a flat 0.45% and that's it!

- Intuitive app & web version: Both the Frankly app and the web version (laptop, tablet) are very user-friendly. The design is well done and the Frankly account opening via ID scan works within a few minutes.

- Paperless: Environmentally friendly thanks to app and website, no paper is necessary. Neither for the account opening, nor for the Frankly tax return.

- Frankly Performance: The performance depends on your strategy. But due to the low fees, the performance is very good. More about this later.

- Ready-made strategies: Frankly offers you predefined strategies that you can easily use.

- Transfer costs are paid: Frankly will pay any transfer costs incurred if you move 3a funds to frankly.

- Community discount: The more people who make provisions with frankly, the cheaper the fees become!

- Background: Frankly is backed by a large company with 150 years of experience.

- Frankly Free Movement (FC): Digital Frankly vested benefits solution as an account or with up to 75% of shares for just 0.44% in fees

Negative Frankly experiences or disadvantages?

- Flat fee: Flat rate sounds straightforward, but in detail, the so-called "all-in" Frankly fees from 0.44% is also charged on cash (uninvested capital). This leads to negative interest on your cash deposit. The same applies to bonds, as these have a low yield, which may result in negative performance. (See later for details)

- No second column: Frankly offers only one pillar 3a solution so far

Frankly App experience and ease of use

The Frankly app is broken down into 3 parts for registration:

- You enter your data and open so that your Account.

- Afterwards you create your Investor Profile and

- then select your Investment strategy off.

The design and simplicity have a very positive effect on our Frankly experience. There were problems with the ID scan in our test at the beginning, but it worked right away when using the driver's license.

By the way, you don't have to be connected to an employee via video call to verify your identity. Everything works directly in the app and so the account opening was completed after about 5 minutes.

Frankly Performance and Strategy Review

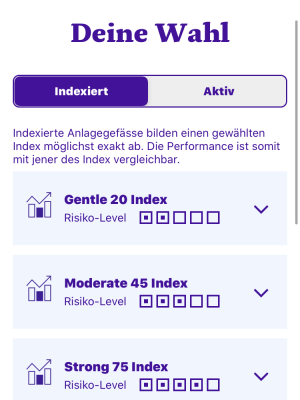

Indexed or Active? This is the question you will be asked by Frankly when you choose "Self-employed". For laymen the question is rather difficult to answer, for insiders it is a philosophy question.

If you are interested in Indexed Anlangen this means that you can rely on passive managed indexes. An example of this would be funds that are managed by an algorithm in a cost-effective and very efficient manner (e.g., "fund of funds"). ETF's).

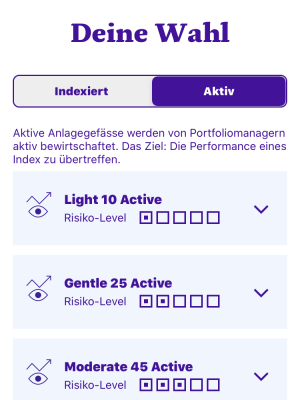

Active on the other hand, would be a fund that is actively managed by people who usually receive high salaries and who, in plain English, "think they are smarter than the others".

Why do we put it so provocatively? It has been proven that most actively managed funds underperform the index. Briefly: We choose the Frankly strategy "Indexed" therefore passive.

It is interesting to note that Frankly already indicates a higher expected return for "Indexed" than for "Active".

Since this is often asked for, there is a note below in the FAQ about the Frankly Performance.

Frankly sustainability check

Since 2021, Frankly investors have been able to invest with high Share quota a sustainable Investment solution.

The active investment group "Swisscanto AST Avant BVG Responsible Portfolio 95" offers the possibility of addressing the issue of the Sustainability more to the fore.

As standard the ESG standard and an annual CO₂ reduction was set as a target. How much CO₂ is to be saved in concrete terms could not be inferred from the communication. In general, it should be noted that sustainability is not a defined term.

If you have a special focus on sustainability, you should take an in-depth look at the topic of sustainable investing employ.

Frankly fees

We could keep the Frankly fees point very short, because here Frankly makes short work. 0.44% All in fee currently charged by Frankly! Currently? Yes, because in the beginning it was 0.48% and as soon as Frankly has collected a total of 5 billion francs, the fee drops to 0.43%. The more successful and larger Frankly becomes, the more users benefit.

Incidentally, the Frankly costs are always the same, regardless of whether you opt for active or passive investments and regardless of how high your equity allocation is.

The all-in fee of 0.44% is very favourable and fair.

New since July 2023: No more fees on cash deposits at Frankly!

Tip: frankly is particularly good value for money with high equity quotas. Especially for young people or if the 3a withdrawal is still more than 10 years away, a high share quota makes a lot of sense. Don't worry, frankly supports you in this.

By the way, your pension fund (2nd pillar) also includes shares. So there's no reason to be skeptical here.

Frankly vs. Viac

| Gebühr ** | Frankly Aktienquote (Strategie) |

|---|---|

| 0,44% | 10% shares (Light 10 Active) |

| 0,44% | 26% shares (Gentle 25 Active) |

| 0,44% | 45% shares (Moderate 45 Active) |

| 0,44% | 75% shares (Strong 75 Active) |

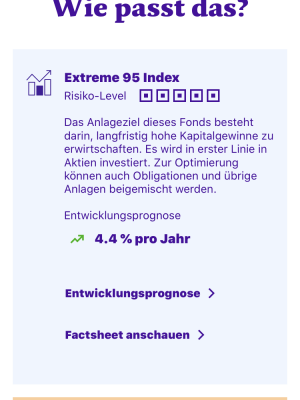

| 0,44% | 95% shares (Extreme 95 index) |

| Gebühr ** | Viac Aktienquote (Strategie) |

|---|---|

| 0,40% | 20% shares (Global 20) |

| 0,41% | 40% Shares (Global 40) |

| 0,41% | 60% shares (Global 60) |

| 0,41% | 80% Shares (Global 80) |

| 0,41% | 97% shares (Global 100) |

**Sources

Frankly strategies and fees / Viac strategies and fees. Errors excepted, please check actuality.

Frankly rating

Frankly

ZKB- Very good value

- Very good and intuitive app

- max. 95% Equity component

- Investment strategy flexible

Frankly freedom of movement

You have a Job interruptionWhat is the reason for this, for example, because you are going abroad or reducing your working hours considerably and are no longer affiliated to a pension fund?

There are so many reasons for a Free movement solution (FC for short). You can temporarily park your pension fund money in an FC account and have it pay interest. The ZKB even provides you with a Frankly Vested benefits deposit with up to 75% equity exposure at your disposal. In this way, you can have your pension money work for you even during longer interruptions in your employment.

Here are some important facts about the Frankly FZ offer:

- 4 Investment strategies from 10% to 75% Share ratio

- 0.4% Interest on account balances

- Optional sustainable Investment

- Only 0.44% fees per year (this is extremely cheap)

- Completely digital open and manage in the Frankly app or web solution!

Conclusion of our Frankly ZKB experience

Are you young and still have a long time until retirement? You don't plan to use your 3rd pillar to buy a house in the near future. Homeownership to use?

Then, theoretically, you can take a higher risk and thus achieve a higher Share price if that suits you. Accordingly, you can, for example, choose a Frankly 95 Extreme Index strategy to obtain a very attractive pillar 3a.

The possible equity component at Frankly particularly high and the app is extremely helpful. Even beginners have no problems opening an account. If you have any questions, you can reach the ZKB support team by phone at any time.

The ZKB therefore passed the check for the Frankly experience report without a hitch! As with other providers, we are of course looking at the whole thing. long-term and will keep you informed.

Does Frankly appeal to you? If so, we give you CHF 35 starting credit with the Code Schwiizerfranke. By doing so, you support this blog and receive a bonus for your provision!

Frankly is not for you? Here's to the Comparison with other 3a providers.

Frankly alternatives

Of course, there are many solutions for the 3rd pillar. But if you're looking for low fees, digital solutions and, above all, high equity quotas, you're well advised to go with Frankly.

In our Pillar 3a securities test, the Frankly 3a experience particularly positive failed

Anyone who wants to have not only their 3rd pillar but also their savings account and investments smartly managed should take a look at our Selma review take a closer look. Selma Finance offers highly innovative solutions in the Swiss market and we have of course taken a closer look at them for you.

Transparency Note: We are in a paid partnership with Frankly ZKB. Regardless, our opinion in this Frankly review is absolutely positive as stated above. We only recommend solutions of which we 100%ig are convinced!

Note on the CHF 35 voucher code:

* You will receive a fee credit of CHF 35. Only valid for frankly new customers. Code cannot be combined with other voucher codes. Redeemable until 31.12.2024. © 2020 Pension Foundation Savings 3 of Zürcher Kantonalbank

25 Responses

First of all, thank you very much for your valuable reports! It helps me incredibly. 🙏🏼

I can't quite figure out Frankly in terms of cash/cash deposits/account balances.

Are the 3 terms you use in your post identical? So is it the uninvested capital that is meant?

And if not, how do they differ?

Then I have a second question about the fees and interest. Your post contains these 3 statements:

1. "All-in" Frankly charges of 0.45% also levied on cash (uninvested capital).

2. new since July 2023: No more fees on cash deposits at Frankly!

3. 0.15% Interest on account balances

Does this now mean I will no longer pay fees of 0.45% for the uninvested capital from July 2023 and will instead receive 0.15% credit interest?

Thank you for your answer 😀

Dear Claudia

Thank you for your message.

Cash/cash deposits and account balances are more or less the same thing, right. We are simply talking about not money invested.

And that's right, since recently the All In fees no longer apply to account balances, but you now receive interest on credit balances. So you profit twice. The amount of interest can and will still change.

Very dear greetings

Eric

Hello

I would like to open an account, but I am already 57 years old. Does it still make sense to invest in Frankly?

Sabine

Hello Sabine

It depends on when you retire or when you want to draw pillar 3a. In 7 years? Then you can possibly still use a small equity component with Frankly (the app will advise you on opening it). However, a high share of equities would not be ideal because of the investment risk.

Of course, if you work longer hours, it's a completely different story 🙂

Hello everybody

New voucher code for frankly 3a pillar.

You will receive CHF 35 when you open a new frankly 3a pillar account ;-).

Greetings to the community and thank you for the great experience report! 🙂

I am very satisfied with the simplicity and professionalism of frankly (ZKB).

Savings tip: 50 Fr. voucher code for you

Kind regards, Silvia

Hi SchwiizerFranke - really like your site/enthusiasm/info. (I've worked in ETFs for years).

If you're ever in Küsnacht and want a coffee/beer,

David.

Kajani recommends VIAC for your Pillar 3a pension.

If you, like Kajani, would like to benefit from the unrivalled low fees, then become a VIAC customer now.

Best of all, thanks to Kajani's recommendation, you pay no administration fee on the first CHF 500.00 of pension assets - for life! 🙌

Use the following code when registering: 7Cm1nvQ

I'm currently testing Raiffeisen Rio in the free pension plan, I also think it's cool and runs great. I'm curious to see whether Raiffeisen will also expand the offer to include 3a

Hello, can I invest my capital with frankly in 2 or more investment funds from Siwisscanto?

If, for example, you have 2 pillar 3a accounts and transfer both to frankly, the depositor protection security is no longer given. Or is this not the case here.

Hello Michèle, if you transfer your money to Frankly, I assume that you also invest in securities (equity funds) there. Right? These are always protected indefinitely because they are written on you personally and do not slip into the insolvency estate in the event of a possible insolvency of the ZKB (or any other provider). Cash deposits in interest accounts are protected up to CHF 100,000.

Does that help you?

I can really recommend Frankly. Not only the fees are a great thing, also the app and the service is top.

Not only was I able to order the transfer from my "old" 3A account hoarded at a third party bank completely in the app,

but also the transfer of the credit to the New Frankly account was already done in only 2 banking days!

Thanks for the interesting article.

Can you still tell how fast one can withdraw (sell) the invested money at Frankly?

Since I expect relatively large movements over the next few years, this is important to me.

With VIAC, rebalancing is only possible at the beginning of each month.

Yours sincerely

Hello Harald

thank you so much for your feedback 🙂

It takes 5-6 banking days for the sale and new purchase to take place. More info under http://www.frankly.ch/faq

Love!

I am very happy with Frankly!

Kind regards

Robert

Thank you very much for the report, very interesting! But do these 0.48% really cover all fees? In the FAQ of Frankly you can find for example

"Not included are the issue and redemption fees for the indexed investment products. These can be found in the relevant factsheet.

In the case of the indexed investment products offered with a high equity component, e.g. Extreme 95 Index or Strong 75 Index, Swisscanto states that there is an issue surcharge of a maximum of 2%.

So this could make a big difference in terms of fees. Are there any testimonials from existing customers about how high this issue surcharge really is in practice?

Hello Richard, thank you for your positive feedback and your eye for detail! Since Frankly has started from scratch, we'll have to wait a little longer for the actual fees.

The flat fee of 0.48% is also charged on cash and bonds (with low yield), so the fee is higher overall, or negative interest distorts the overall result. After all, not every client goes into stocks at the maximum and especially with conservative strategies Viac is cheaper than Frankly (0.39% fee). In my experience, young people with a long investment horizon often go into stocks with more than 70%. With such a strategy, Frankly is cheaper than Viac.

Many greetings!

Hello Eric

I am still not clear about the issue and redemption fees. Will I be additionally charged the respective issuing and redemption fees when buying/selling the investment products, or is this included in the lump-sum settlement?

Many greetings

Hello Peter

directly apparent at least not. Has anyone here already made other experiences or nachgehakt?

no fees or other surcharges are charged, you are charged the daily rate of funds.

I had bought for good 40k the Extreme 95 funds and within two weeks with good 10% profit again rausgejagt.

on the statement are the daily rates, where is published.

Disadvantage is halt, with purchase or sales pass up to three days, one has no control to which course the really traded.

with normal days can be to zero difference, but with some days some percentages are quite in it.

Personally, I'm not all that excited about Frankly.

all these instruments are possible at other banks without fees. possibly already included in the fund.

at Frankly is every three months with me good 50 CHf abezogen, verzins is with 0.05 haha.

So every year minus interest credit balance, yet 200CHF less for my pension, if I do not actively trade.

I'm not sure if I understand correctly that here is actively "trading" in the 3a account or whether the action was only for testing. There is no investment advice here. However, I would like to point out to the general public that retirement provision can be seen as a long-term investment and that the long investment horizon means that less consideration has to be given to short-term fluctuations. Active "trading" in the 3a account is not necessary or recommended in my opinion.

Love you! 🙂

Of course there are still the TER surcharges (annual investment bonds) which are around +0.21% for most investment options. You can call the Frankly free number, they will explain more. With 0.46% everything is covered except the TER, but this is still cheaper than the normal bank offers for pillar 3a. But remember, money that is not invested is also subject to a 0.46 fee. That is with normal Säulen3a often not with fee. Lg Adrian E.

I can choose a specific topic for one of them, such as sustainable products. Or are there only flat-rate packages?

Hello Rainer, at Frankly the investments have been subject to the Responsible Standard and thus the ESG guidelines since October 2020. With Viac you can

choose a sustainable focus. Sustainability is not a defined term, here you should look in detail if this is important for you.

Kind regards