Findependent review: The big review

When Schwiizerfranke was founded, investing for investors with small to medium assets in Switzerland was still complex or expensive. In the meantime, there are ever simpler approaches for private investors. Findependent is one such provider that does this specifically transparent and simple in Switzerland made possible. We have Findependent Sync and corrections by n17t01 and would like to share our findings with you in this Findependent review.

What makes Findependent's offer special on the market and what speaks for and against Findependent, we clarify in this Findependent Review!

Table of contents

Findependent explained

Since the spring 2021 stands the Findependent Investment platform available for investors. The founding team around Matthias Bryner has the mission of making investment in Switzerland as simple and understandable as possible for beginners.

Complexity is deliberately avoided, and everything is kept as simple and as transparent to reach newcomers at eye level. The strong digitalisation in the offer ensures low costswhich are intended to make investing more attractive to investors.

We find the concept exciting and have therefore agreed with Findependent on a Interview exchanged. The following information is the result of a conversation with the managing director.

What's important with young fintechs like Findependent is the Seriousness and Security of the financial investments. We therefore welcome the fact that Findependent has Mortgage Bank Lenzburg as Partner Bank has chosen.

Hypi Lenzburg", for example, is already known as a partner bank of Neon. In the registration process at Findependent, an account is opened in your name at "Hypi", where your investments and cash deposits are later held in your name.

If you are concerned about financial security, you can rest assured that cash deposits of up to CHF 100,000 and unsecured securities (shares, ETFs, etc.) are covered by the Swiss deposit insurance are protected.

Findependent strategy

Passive investing with Findependent

The Findependent investment strategy is passively oriented and is suggested for you after a short assessment of your risk profile. You can manually adjust the investment strategy afterwards, as you might have done with providers like True Wealth or perhaps Finpension in the 3a area.

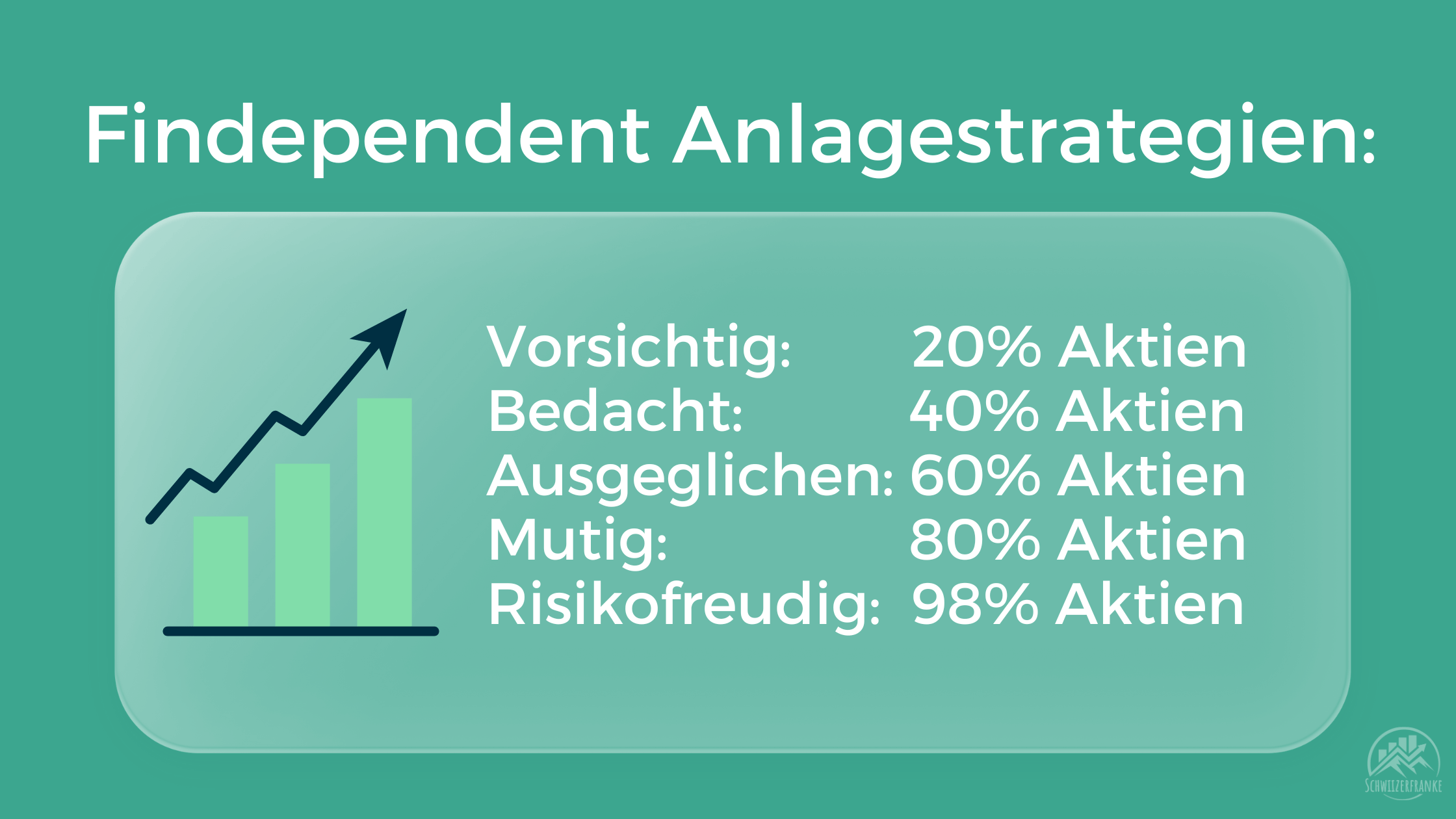

There are currently 5 Strategies ("Cautious", "Prudent", "Balanced", "Courageous" and "Risk-taking") are available. The "Risk-taking" strategy with 98% shares is particularly exciting for investors with a longer horizon (in our opinion at least 10 years). Incidentally, the well-known economist and professor Thorsten Hens from the University of Zurich is on the investment committee.

The Findependent strategies also contain shares in bonds, real estate and cash in accordance with the respective equity quota. They each consist of ETFs and thus implement a cost-efficient, passive and broadly diversified Investment Style.

For all "nerds": By the way, the currency risk is not hedged. The foreign securities are thus subject to a foreign currency risk. But hedging always costs ongoing fees, which is why this is usually not done.

Sustainable investing at Findependent

Sustainability is approached at Findependent via the exclusion procedure. The selected ETFs are screened and controversial companies that are involved in war weapons or oil production, for example, have been removed. The positive thing about this is that the sustainable approach has been implemented in such a way as to no increased costs and thus has a positive impact on our Findependent experience report.

Your own investment solution: Doing your own ETF savings plan?

Own investment solution with Findependent:

When Schwiizerfranke went online in 2019, there was no option for an ETF savings plan in Switzerland. With the subsequent launch of Findependent's "own investment solution", we are now getting heart-stoppingly close. Because Findependent has been offering the option of its own ETF strategy since the end of 2021.

You want your ETF savings plan instead of via Roboadvisor prefer to do it yourself?

At Findependent, you can choose from over 40 pre-screened ETFs and create your own ETF strategy. These now also include special dividend, Bitcoin and gold ETFs.

The respective ETF costs (TER) are listed in a structured way in the overview and you can view the sustainability ratings (ESG) in the factsheets.

Findependent performance and return

The Findependent Performance can be viewed transparently on the provider's website.

So before you decide on a strategy, you can analyse the historical Findependent yield for this strategy.

You can find these in the PDF fact sheets of the respective strategy.

Findependent fees

| Up to CHF 2'000 | From CHF 2'000 | From CHF 50,000 | From CHF 150,000 | From CHF 250,000 | From CHF 500,000 | From CHF 1'000'000 |

|---|---|---|---|---|---|---|

| Free of charge | 0.40% | 0.38% | 0.35% | 0.33% | 0.31% | 0.29% |

Official Findependent Fees:

The minimum investment at Findependent starts at CHF 500. Up to CHF 2'000 there are currently no custody or management feeswhich is of course very customer-friendly.

The official Findependent fees start then from CHF 2'000 and lie with 0.40% per year. Added to this are exchange rate surcharges or stamp duties, for example. Details of the Costs with a Example you can find here at this link.

Overall, the costs are thus very inexpensive and are roughly in the range as Selma or True Wealth. Especially for beginners the bonus is very exciting, which is even better for you as a Schwiizerfranke reader.

Findependent fees for Schwiizerfranke readers:

For Schwiizerfranke readers there is a deal with Findependent. If you enter our code and then place your first investment with Findependent, you will receive a credit of CHF 20 to your Findependent account! What you have to do? Enter the Coupon code "schwiizerfranke« on!

Investing for children with Findependent

Since 2023, they have made it possible for Findependent to Investing money for children introduced. So now you no longer have to hope for interest for your child or your godchild, but can also invest in shares for minors.

Important: Legally, the children's account is in your name. This way you can pay tax on it properly and transfer the assets to the child when you think the time is right.

As Findependent now generally offers several investment goals or pots, you can now save for several goals at the same time. You can see why this is so advantageous in the following example:

- Investment objective 1Your long-term investment goal until retirement with maximum equity exposure

- Investment objective 2: Your medium-term goal for a trip around the world with a balanced investment strategy

- Investment Objective 3: The pot for your godchild, which follows a long-term strategy.

- …

Findependent Lion's Den

Those who already have a Findependent account or have been considering it were certainly pleased about the Findependent The Lion's Den Appearance. The young fintech was able to raise CHF 150,000 for further developments there a few years ago.

Also the cooperation with Neon was strengthened as a result, as Roland Brack has now invested in both Swiss fintechs. The attention generated by the Findependent Höhle der Löwen TV appearance also naturally attracted attention and thus new customers.

The brand of the 20'000 customers and more than 250 million francs under management was broken in 2024.

We are curious to see what Findependent will launch next for its clients thanks to the investment. The own ETF investment solution was already an innovative solution that many people might have been waiting for.

Negative Findependent experience?

Our Findependent experience are consistently positive so far. The reviews for Findependent are also positive on other platforms. very positive and the Findependent tests are solid and good.

Findependent is still relatively new. Should our experiences change, we will be happy to update and share them with you here.

In the meantime, we have even had the opportunity to meet the founder and CEO Matthias Bryner in person and exchange ideas with him. This further strengthened our positive assessment, as we were able to gain a good insight into the company's further development steps.

Because it is sometimes asked whether Findependent serious and one thing is certain: Yes, the provider is secure and trustworthy. This is shown by numerous real tests and this Findependent evaluation from us.

Conclusion of the Findependent Review

Findependent is uncomplicated, transparent and simple. Other Findependent reviews on the Internet are very positive. Conversely, simplifications are of course always limiting. After all, Findependent is not the right place for anyone who likes to actively intervene in their investments, wants to see more information about the exact ETFs or similar.

But who likes Invest uncomplicatedly can test this with Findependent and deliberately keep the costs low.

Our Findependent experience report can be very positive summarise. By the way, you can find a Findependent comparison with other digital asset managers.

We are excited to see how Findependent will establish itself on the Swiss market in the long term and what the first investment experiences with real customer experiences will look like.

You have more Questions to Findependent or suggestions on the subject of investments?

Leave us a comment there!

Transparency Note: This post was created in collaboration with Findependent. We have not received any compensation for it. The presentation and description has been created independently and freely by us.

About the author

Eric is the founder of Schwiizerfranke.com and certified IAF wealth advisor. Since 2019, he has been helping Swiss citizens to organise their finances comprehensibly, independently and efficiently.

📌 Note: This article is for information purposes only and does not constitute personalised investment advice.

I have been a Findependent member for a long time. Save CHF 3000.00 in administration and custody fees for life with the friendship code.

With this code you can secure lower fees at FIndependent for life :).

With the code you can invest the first CHF 4'000 without administration and custody fees when you open an account with findependent - that's a really great deal! My experience with findependent was great. The app is easy to use and feels very authentic. If I had any questions, I could just call and Vincent or someone from the team would get straight back to me. It's really fun to invest in such an uncomplicated way. Thank you, Matthias, for developing something so great!

Greetings from Schaffhausen! 🤍

What is this code? 🙂