The big vested benefits account comparison: interest rates and custody accounts 2025

A vested benefits account is a specialised pension solution in which you can invest your Temporary storage of pension fund assets if you are between jobs or leaving Switzerland. The best providers in the test for discretionary deposits and accounts can be found below.

Table of contents

The best vested benefits accounts at a glance 2025

| Criteria | Finpension | Viac | Frankly | Descartes |

|---|---|---|---|---|

|  |  |  | |

| 💰 Interest rate account | approx. 0.5% | approx. 0.3% | approx. 0.2% | - |

| 💼 Depot fees | 0.49% flat rate | 0,0-0,43% | 0,44% | 0,2-0,4% |

| Opening fee | Free of charge | Free of charge | Free of charge | Free of charge |

| 🏛️ Location Foundation | Schwyz (tax advantageous) | Lucerne | Zurich | Schwyz (tax advantageous) |

| ⭐ Valuation factor | Highest interest rates | Best integration | Best app | Lowest fees |

| 🔍 Special feature | Flexible investment strategies (20-100% Equities) | Seamless integration with pillar 3a | User-friendly app | Depot solution only |

| 🔗 To the provider | Read test report | Read test report | Read test report | Read test report |

If you take a break between two jobs, you have to keep your Pension fund benefits in a vested benefits account. You can choose this yourself. Incidentally, compared to some other countries, many vested benefits accounts are permitted in Switzerland, so you can decide for yourself which vested benefits solution you want to use for your savings. Pension assets in the second pillar. This is particularly practical if you have more than 100,000 francs assets and you are not sure when the new pension fund will take over your capital.

To help you find the provider that suits you best, we have put together a Vested benefits account comparison created. In it you will find the best providers and also a comparison between accounts and custody accounts.

What is a vested benefits account?

A Vested benefits account is an account with a vested benefits foundation where you can temporarily store your pension fund assets if you are between jobs. Many vested benefits foundations also offer a Depot The decisive factor is which form of freedom of movement solution is suitable for you.

The reasons for this can vary, for example

- A World trip

- Recording of the Independence

- A longer Unemployment

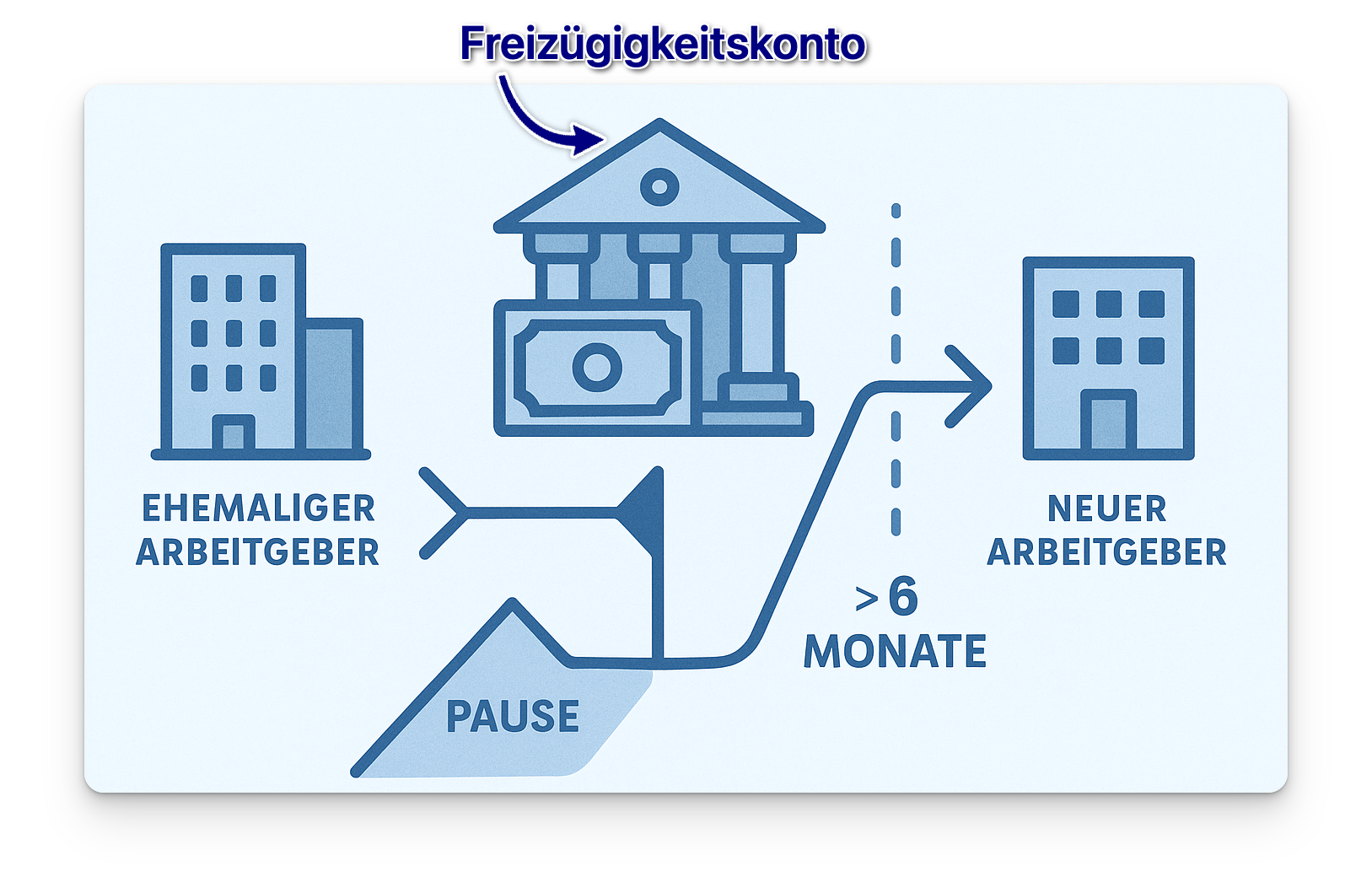

As soon as you have been in the 6 months you do not have a new employer, you must transfer your money to a vested benefits account.

If you do not do this, the money will automatically be transferred to the Foundation Reception centre Collecting facility BVG transferred. This serves as a safety net so that no capital is lost. You can move this credit again at any time, but you must actively take care of it.

Advantages of a vested benefits account vs. a vested benefits custody account?

There are basically three types of solutions for depositing your vested benefits: Vested benefits account, Vested benefits deposit and Vested benefits policy.

The difference here lies mainly in the type of provider and the Return on investment. A vested benefits account is offered by a vested benefits foundation, which is often set up by a bank. A vested benefits policy is a premium-free life insurance policy. It is therefore offered by an insurance company. A vested benefits custody account is basically the same as an account, but your assets are invested in Securities created.

What is suitable for whom? Account vs. custody account at a glance

| Vested benefits account | Vested benefits deposit |

|---|---|

| Suitable for | Suitable for |

| - Short to medium-term investment horizon (1-3 years) | - Long-term investment horizon (5+ years) |

| - Planned advance withdrawal for residential property | - Early retirement without immediate capital requirements |

| - World trip or sabbatical with return to work | - Emigration with later payout |

| - Risk-averse investors | - Investors with medium to high risk tolerance |

| Advantages | Advantages |

| - Capital preservation without fluctuations in value | - Higher yield possible (historically 4-7% p.a. over longer maturities) |

| - Immediate availability of the money | - Diversification of your investment portfolio |

| - Planning security for medium-term goals | - Inflation protection through tangible assets |

| - Mostly free of charge for account management | - Flexible investment strategies (20-100% equity component) |

Who is a vested benefits custody account suitable for?

Securities are generally well suited if you have a long-term investment horizon and don't need the money in the next few years. This allows you to benefit from increases in value and you are not under pressure to sell if the market fluctuates in the meantime. This could be a good solution if you are taking early retirement and have other sources of income.

Advantages of the vested benefits custody account:

- Higher return possible (historically 4-7% p.a.)

- Diversification of your investment portfolio

- Inflation protection through tangible assets

- Flexible Investment strategies (20-100% equity component)

Who is a vested benefits account suitable for?

If, on the other hand, you are planning a one-year trip around the world or already know that you want to make an advance withdrawal to buy a home in the near future, then you are generally better off with an account. Although you hardly earn any interest here, your capital is stable and not exposed to market fluctuations.

Advantages of the vested benefits account:

- Capital preservation without fluctuations in value

- Immediate availability of money

- Planning security for medium-term goals

- Mostly free of charge for account management

How do you compare vested benefits accounts in Switzerland?

If you need a vested benefits account in Switzerland, you should pay attention to a few points when making your decision.

Important criteria when comparing vested benefits accounts

With an FC account, you do not receive a return as with a custody account, but you do receive Interest. Although these are generally relatively low, even 0.1% can make a difference with a large balance.

Another important point is the Fees. Ideally, the account and the cancellation should be free of charge. The fees for an early withdrawal for home ownership can also vary greatly, but are almost always between CHF 200 and 500. You should also check any transfer or purchase costs in order to save tax.

If you are looking for a vested benefits custody account, you should also consider the Costs for your systems check. It may be worth comparing vested benefits accounts with an interest rate before you decide whether you want to liquidate your money in a vested benefits account and switch to a custody account.

Emigration plans? That's why the location of your vested benefits foundation is so important!

If you only want to have your vested benefits paid out after moving abroad, the so-called Withholding tax is not due in your former canton of residence, but at the domicile of the vested benefits foundation. And there are major differences here: some cantons - for example Schwyz or Train - are known for their lower tax rates. So if you know that you want to move abroad in the future and only then have your assets paid out, you should look specifically for providers based in a tax-favourable canton. However, as long as you are registered in Switzerland, your canton of residence will continue to determine your tax burden. So think about how long you want to stay in Switzerland and when you want to withdraw your capital at an early stage - this could save you a lot of tax. Save taxes.

The best providers of vested benefits accounts and vested benefits custody accounts

Now that you know what you should look out for when choosing a vested benefits account or vested benefits custody account, you are ready for the vested benefits account comparison.

Here are our favourites:

- FinpensionFinpension offers both an account and a custody account for your vested benefits. The account is free of charge and at the depot you pay 0,49% all-inclusive.

- ViacViac offers not only a depot for the Pillar 3a a vested benefits account and custody account. The account is also free of charge and at the depot you pay between 0 and 0.43% all-inclusive.

- Frankly: With Frankly, you can also choose between an account and a custody account. Here too, the account is free of charge. The fees for the custody account are 0,44% all-inclusive.

- DescartesDescartes does not offer a vested benefits account, but only a custody account. The costs for this are between 0.2 and 0.4% all-inclusive.

What is the interest on vested benefits accounts?

You can combine a vested benefits account with a regular Savings account simply for your pension provision instead of for your private money. So you receive interest in return.

Current interest rates for vested benefits accounts

The interest rate on a vested benefits account depends on the individual provider and changes from time to time. Regardless of the provider, however, interest rates have been very low for years and are generally less than 1%.

If you have a longer investment horizon and don't need your vested benefits for a while, you will usually have a significantly higher return with a custody account. Return on investment. All of the providers mentioned above also offer low flat-rate fees. This can work in your favour because you can generate more income in the long term.

How does interest affect my vested benefits balance?

The interest will give you a small return on your vested benefits balance. For example, if your balance CHF 500,000 and you 0,5% interest, then after one year you will have CHF 2'500 more credit.

What looks good at first glance, however, in reality means a Negative return. Because while interest rates have been below 1% for years, the Inflation over 1% for years. So in the end you are losing money instead of receiving a return.

Calculation example: Account vs. custody account over 10 years

| Vested benefits account (0.5% interest) | Vested benefits custody account (5% p.a., 80% shares, after deduction of fees) |

|---|---|

| Initial amount: CHF 100,000 | Initial amount: CHF 100,000 |

| After 10 years: CHF 105'114 | After 10 years: CHF 162,889 |

| Profit: CHF 5'114 | Profit: CHF 62'889 |

| Difference: CHF 57,775 more in the deposit after 10 years! | |

Tips for maximising the return on my vested benefits account

If you want to achieve the best possible return on your vested benefits, then you are better off in the long term with a Depot solution best.

With all of the providers mentioned above, you can choose a strategy that suits your Risk profile fits. For example, if you only want to invest in the medium term and may need the money again in 3 to 5 years, then you can also choose a strategy with a low equity allocation.

Finpension for example, offers an equity component of between 20 and 100% on. As a general rule, the higher the proportion of equities, the higher the potential return, but also the greater the potential fluctuations in value. So if you want as much security as possible, you can choose the lowest possible equity ratio.

How do you open a vested benefits account?

If you want to open a vested benefits account or custody account, it's easy with the providers presented here. Perhaps you have your Pillar 3a If you are already using one of these apps, you can usually add the vested benefits account with just a few clicks.

If not, you can simply download the relevant app and create an account. The process is basically Fast and uncomplicated. But you certainly need your ID or your passport and your AHV numberso have this ready.

When and how can I have my vested benefits paid out?

As soon as you take up gainful employment again, where you are employed again and earn more than the BVG minimum wage of CHF 22,680 (as of 2025), you must transfer your vested benefit assets to the Pension Fund of the new employer. If you have several accounts, you can also pool all the money in a vested benefits account and pay it into the new pension fund later.

You can also request a payout if you want to use your credit for the Purchase of residential property use or emigrate would like. This may be worthwhile when purchasing if you want to take any tax aspects into account.

Please note that such early withdrawals are often subject to fees of between CHF 200 and 500 are incurred. In addition, your credit balance is usually Taxed separatelyThe exact rates and any deductions depend on the respective canton. With Disability or Death the capital may also be due, which varies from canton to canton depending on your place of residence. Enquire in good time to avoid any nasty surprises when transferring or paying out.

Conclusion on the vested benefits account comparison

With a vested benefits account, you have the freedom to decide how your capital is invested. Pillar 2 is to be stored or invested in the meantime. You receive a relatively low interest rate on an account, but you have the Securitythat your credit balance could not go into the red due to market fluctuations.

Another option is a vested benefits custody account. Your assets are invested in Securities invested. Especially if you don't need the money for several years or decades, you may be able to earn several thousand francs more than if you leave it in an account.

In any case, when choosing a provider, you should make sure that the account is, if possible free of charge and the fees for the custody account are low and transparent are. In this way, you can find the best vested benefits account for your needs and benefit from optimal conditions in the long term.

After all, you only have to close your vested benefits account when you want to integrate your assets into the next pension solution or make a definitive withdrawal. Always pay attention to how high the Property tax and how your vested benefits will be paid out in the Leaving Switzerland taxed so that you can keep as much of your pension capital as possible.

FAQ

Can I have several vested benefits accounts?

Yes, you can open several vested benefits accounts with different providers in Switzerland. This can be particularly useful if you have more than CHF 100,000 in pension assets. Although there is no statutory deposit protection, by splitting up your assets you spread the risk of a possible default and can gain more flexibility when withdrawing later.

When do I have to open a vested benefits account?

You must open a vested benefits account if you leave your employer and are within six months you do not take up a new position with a pension fund connection.

Can I pay money into my vested benefits account?

No, you cannot pay any additional money into your vested benefits account. It is only used to store existing pension fund assets.

What tax advantages does a vested benefits account offer?

The credit balance in the vested benefits account is exempt from tax during the term of the account. Property tax exempt. At the time of payment, there will be a reduced rate taxed separately from other income.

Can I convert a vested benefits account into a vested benefits custody account?

Yes, most providers allow you to convert your vested benefits account into a vested benefits custody account at any time and vice versa.

UBS vested benefits account experience?

Many existing customers choose the UBS vested benefits account out of convenience. However, if you are looking for good interest rates or a flexible vested benefits custody account, you will usually find better conditions with Finpension or Viac. A comparison is particularly worthwhile for larger balances - especially if you don't just want to "park" your vested benefits account, but use it sensibly.

Raiffeisen vested benefits account - a good choice?

Raiffeisen is popular in many regions - also for vested benefits solutions. The account works well, but the interest rates are generally below the market average. Raiffeisen is less suitable for securities investments, as direct custody account management is often not integrated. So if you are planning to invest your assets for the longer term, you should also take a look at the custody account options in the article.

PostFinance vested benefits account - how does it perform?

PostFinance offers a vested benefits account with a stable infrastructure but a low interest rate. A vested benefits foundation with a custody account solution - such as Frankly or Finpension - is usually more flexible and offers better long-term returns. If you have more than CHF 100,000 at your disposal or want to make more of your pension assets, it is worth taking a second look at the custody account solutions in the comparison.

How can I open a vested benefits account?

These days, opening a vested benefits account is quick and digital - often directly via the provider's app. All you need is your AHV number and proof of identity. Whether Finpension, Viac, Frankly or another provider: Your account will be active within a few minutes. In this article, you can find out how to choose the right provider - depending on whether you're a short-term investor or a long-term investor.

About the author

Eric is the founder of Schwiizerfranke.com and certified IAF wealth advisor. Since 2019, he has been helping Swiss citizens to organise their finances comprehensibly, independently and efficiently.

📌 Note: This article is for information purposes only and does not constitute personalised investment advice.