Yuh App experiences 2026

and 3 tips for you!

Yuh was born out of two very well-known Swiss financial institutions and aims to combine 3 things in one app: Pay, Save and Invest.

What emerged from the collaboration of Swissquote and Postfinance you will find out in this Yuh test. How the Yuh fees compare, where you are better off using other providers, and how our Yuh App Experience in detail, you will read in the next 5 minutes.

So that you can have positive yuh experiences yourself, there are 3 Tipsto get more out of the app!

Table of contents

3 important Yuh tips for you!

- To Yuh save feesOpen savings plans and make purchases only from somewhat larger sums. Details you will learn in the article.

- Avoid Currency exchange and save yuh exchange rate fees. You'll find out how in a moment.

- Use and receive the free Swissqoinsduring the registration process by entering the Yuh Bonus Code YUHFRANKE (all capitalised)!

Promotion: Get CHF 50 worth of trading credits for free with our Yuh promotion code!

In addition, with our Yuh Promo Code Even 250 Yuh Swissqoin will be credited automatically if you have deposited more than CHF 500!

Our Yuh App Review Summarized

With the Yuh app, you can conveniently and with a single provider manage your Savings and Investment account receive, in the Pillar 3a provide for and even Payments make. Since the integrated pillar 3a was added to the 2023 pension plan, banking, investments and pension provision are offered in full at Yuh.

Regular updates and new features (such as Savings plans from CHF 25 or the Yuh Pillar 3a) are launched and the app is continuously optimised. Those who had their first Yuh experiences at the launch now benefit from significantly more functions within the app.

The Yuh fees are flat or at least very simple and straightforward. The transparency of the costs, as well as the design, appeal specifically to young customers.

The conclusion of our short version: Yuh.com makes it easy to get started with investments in shares, ETFs or cryptocurrencies. Savings goals can be set up quickly and the banking offer is attractive. If you have a growing or larger portfolio, you are more likely to switch to other providers in the long term due to the fees (perhaps Swissquote itself) change.

Nevertheless, the app can be a supplement thanks to Yuh ETF savings plans or quick access to cryptocurrencies. Our Yuh review is therefore consistently positive.

All details and explanations following!

The yuh fees in detail

If only it were that simple! No custody fees, no account management fees and no fees on payments within Switzerland. That's how the yuh fees are advertised.

You probably remember that the Swiss Investment App was not launched by Caritas. So let's take a closer look at Yuh costs and identify typical fees:

- Free Yuh card Mastercard

- ETFs can be saved free of charge for Yuh ETF savings plans are very popular and repeatedly generate positive Yuh reviews.

- Custody fees and Account management fees do not exist, so they are free of charge.

- Per week there are a free Cash withdrawal. Afterwards costs each additional withdrawal CHF 1.90. That is very fair.

- Transfers in the EU in currencies other than euro / SEPA zone cost CHF 4. You can see which countries are included in the app.

- Currency exchange cost 0.95%. So any stock purchase or yuh ETF savings plan in another currency will directly cost you just under one percent yuh exchange rate fees.

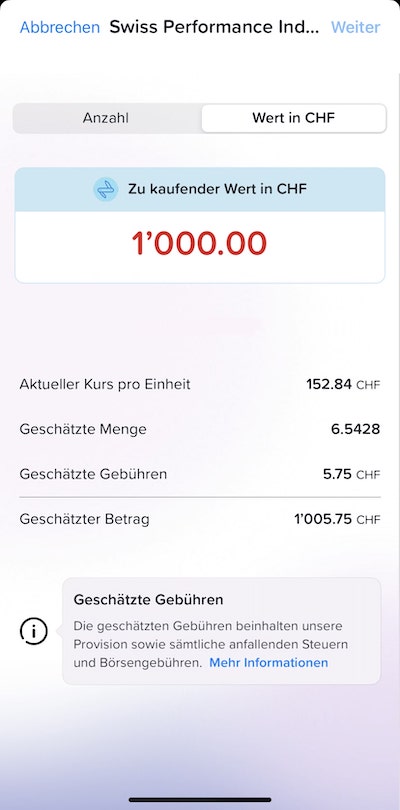

- Trading fees for Yuh share purchases or ETF purchases cost 0.5%. Minimum fee CHF 1.

- The purchase and sale of Yuh cryptocurrencies costs each 1% Fees.

- The Yuh Pillar 3a Fees are made via a All-In-Fee from fair 0.5% solved.

Our conclusion on yuh fees: They are uncomplicated and fair for the offer (savings plans etc.). However, you should avoid regular purchases of less than CHF 100, as otherwise the costs will be too high in percentage terms due to the minimum fee. If you make a savings plan, choose a savings instalment of CHF 500 or more if possible. Then you will be travelling very cheaply. If this is too much, you can, for example, only make a purchase every quarter instead of every month.

Tip #1: Make savings plans and purchases less frequently, but in larger amounts. This way you save a lot of fees in percentage terms. Small purchases are more expensive.

Action: Get trading credits of CHF 50 for free with our code!

In addition, with our Yuh Promo Code Even 250 Yuh Swissqoin will be credited automatically if you have deposited more than CHF 500!

Tip #2: Avoid currency exchange and save yuh exchange rate fees. If possible, buy securities in CHF. This way you also avoid the so-called exchange rate risk.

All Yuh advantages and features

- Let's start at the back. The Yuh tax statement is free of charge. Why is this worth mentioning? It costs CHF 100 for Swissquote itself, but you can also order the eTax tax statement for your Yuh tax return, which costs CHF 25, but takes all the work out of entering your trades etc.

- You can invest via a normal purchase or a Yuh savings plan. Yes, there are Yuh savings plans on shares, ETFs and soon also on cryptocurrencies.

- If you are not (yet) investing and are keeping your money in cash, depending on the currency, there are now also Interest At Yuh! However, this varies greatly and depends on the base rate.

- mobile payment seems to be a major effort for all fintechs. If you want to use Google Pay with Yuh, it already works. Samsung and Apple Pay, as well as TWINT, are also available.

- Probably the biggest advantage of the Swiss Trading App? One app for everything! And it works well. Banking, savings plans with virtual savings goals and also investments work flawlessly in the Yuh test.

- The Yuh account opening is fully digital, by the way. If you are already a Swissquote or Postfinance customer, the process is even faster. With the Swissquote Login, for example, you can start directly and without further data entry.

- You want to work with Yuh eBill use? The Yuh eBill function is available and ensures less office chaos.

- Transparent Roadmap with all upcoming features. So you can always see what is currently being developed for you: A youth account, e-tax statement, automatic categorisation of your expenses and much more!

What are the yuh disadvantages

- Investing experience with Yuh: Important order types such as a Limit order are currently still missing, but are already listed on the roadmap for developments.

Buy stocks and ETFs with Yuh

The Yuh app has a simple structure. You can also hear this in other Yuh Bank experiences. In addition to "Pay" and "Save", there is also a tab for Yuh Investments. Here you can choose between a one-off investment or so-called "recurring investments", i.e. a savings plan.

The complete Yuh ETF list can be found directly in the app or on the website. The selection includes popular global ETFs, Swiss indices and thematic investments.

A yuh Savings plan is possible from CHF 25 and can be triggered either weekly or monthly. The perfect way to avoid having to worry about whether now is the "right time". There is never such a thing, and you can spread your timing risk perfectly with a savings plan. ETF savings plans are very popular, unfortunately only rarely available in Switzerland and therefore a great advantage in the trading app, which was founded by PostFinance and Swissquote, but is now fully owned by Swissquote!

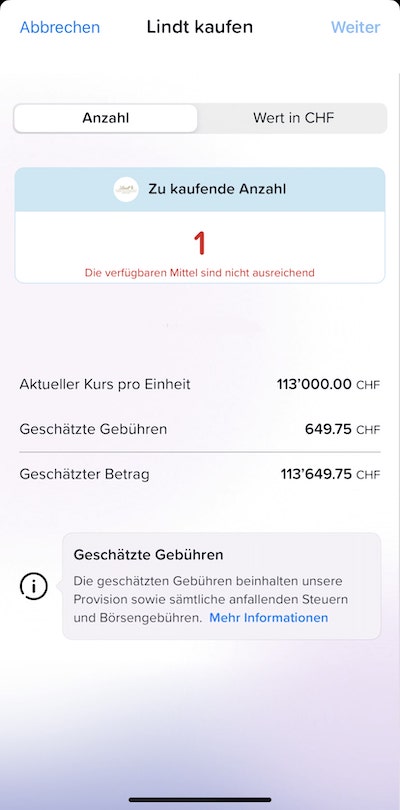

2022 were recorded at Yuh Fractional Shares launched. What does this technical term mean? Let's say you want to buy Lindt and Sprüngli shares. Just 1 of these shares costs about as much as a sports car. Does that make sense for a beginner? Probably not, as that would be "all your eggs in one basket".

When you buy shares or other securities at Yuh, you can either buy a "number" in units or buy a "value in CHF".

So instead of buying 1 Lindt share for around CHF 110,000, you switch to the "Value in CHF" tab and buy, for example, 50 shares for CHF. This fraction of the share is called a "fractional share" and Yuh Bank takes over the denomination for you.

Yuh Themes or trend themes are ETFs or baskets of shares on a specific topic. You can invest in e-mobility or blockchain, for example. Investments in thematic funds sound exciting and are popular in marketing departments, but you should treat them with caution. My personal experience is in line with the statement in this Fintool videoswhich I would be happy to recommend to you if you are interested.

Tip no. 3: Use and receive the free Swissqoins by entering the code YUHFRANKE when registering!

The Swissqoin SWQ has risen in value by around 70% since its launch! It could therefore be interesting not to sell the Swissqoins you have received, but to hold them instead.

Save and earn interest with Yuh

With Yuh, there is currently no interest on your savings! As soon as interest is available again: It is important to note that you will need to transfer the money to a Yuh Saving pot have to move. You can create these with one click under the "Save" tab in the app.

Everything you need to know about saving with Yuh at a glance:

- The Yuh interest is accumulated, so you receive interest on your interest!

- They are paid out annually at the end of the year on 31 December.

- In order to receive the full amount of interest, the money must be in a savings target.

Yuh Pillar 3a

Since August 2023, the Yuh 3a Solution ready:

- Precautions from 1 franc

- Fair and transparent All-in charges of 0.5% (this includes custody fees, investment fees (TER), currency exchange, management fees, strategy changes, deposits, withdrawals, account opening and closing)

- A fully digital Yuh Pillar 3a solution directly in the Yuh App

You can choose from 5 different Yuh Pillar 3a investment strategies:

- Mild with 20% Equity ratio

- Hearty with 40% Share component

- Spicy with 60% Share quota

- Sharp with 80% Share component

- Fiery with a full 98% of shares

Yuh children's account: Yuh 14+ youth account

The Yuh 14+ account is aimed specifically at teenagers between the ages of 14 and 17 and offers the following benefits:

- Free Swiss bank account with your own IBAN

- Integrated Yuh TWINT for fast payments and money transfers

- Free Mastercard debit card for worldwide payment

- One free cash withdrawal per week in Switzerland

- Attractive interest rates on savings (the exact interest rates may vary)

- No account overdraft possible - an important safety aspect for parents

- Deposit protection up to CHF 100,000 by FINMA

What makes it special: Young people can use the account open independently, without a parent's signature. This encourages a responsible approach to finances right from the start. It also gives teenagers their first insights into the world of investing by allowing them to observe trends - without taking any financial risk.

For parents, the Yuh 14+ offers a Safe alternative to conventional youth accounts, as no overdrafts are possible and at the same time the necessary level of Independence is guaranteed for the young people.

Buy cryptocurrencies with Yuh

When you work with Yuh cryptocurrencies If you want to buy cryptocurrencies, you can choose from a constantly growing pool (currently about 30 different coins). So you can find all common cryptocurrencies like Bitcoin, Ethereum, Cardano, etc.

By the way, according to the support, the crypto investments are not executed via derivatives. But via Swissquote will be available at Bitstamp & Coinbase real cryptocurrencies purchased and subsequently safely on Cold Wallets (offline storage) secured.

The Yuh crypto fees are a flat rate of 1% per purchase or sale. A minimum fee of CHF 1 is charged for small transactions.

In your yuh Wallet your crypto investments are clearly listed.

The in-house Swissqoin is a token of its own that is used by the community in the Yuh Refer a Friend programme. Swissqoin is therefore effectively Yuh's own cryptocurrency. If you use our Yuh Code "YUHFRANKE“ (all capitalised), receive trading credits of CHF 50 as a gift and if you invest more than CHF 500, you will automatically receive another 250 Swissqoin as a gift!

You can then exchange the Swissqoin for another currency or hold it. The Swissqoin price should rise in the long term through re-investments by the company.

Is there a yuh tax statement?

Investing is fun with attractively designed trading apps, but at some point the time comes for the Taxes. At the latest then one or the other thinks about why one has so casually executed countless trades on the couch.

With some providers, this would be madness when it comes to tax returns. Fortunately there are a free Yuh tax statementwhich you can use for your tax return.

Conclusion

This Yuh test already running since day 1 of publication. Since then, many new functions have been added, the app has reliable works and also the Yuh experiences from readers were extremely positive.

The transparent Yuh fees make it easy for users to see where costs and fees apply. Thanks to our tips, you can test Yuh and not only save on fees, but also Swissqoins as a gift via the Refer a Friend programme. Overall, the offer at Yuh Gebühren is extremely good value compared to similar providers.

However, if you are looking for a broader product selection and more trading functions, you may be better off with Swissquote better off by themselves.

Which feature would be particularly important to you in the Swiss investment app? Feel free to share your opinion in the comments.

FAQ

How does Yuh vs Revolut perform?

Internationally in use, Revolut vs Yuh would probably be cheaper. For customers from Switzerland with main expenses in Swiss francs, will be Yuh probably more attractive be

There is no clear winner in the Yuh vs Revolut duel. Both providers have no deposit fees and offer free cards. Yuh offers a free cash withdrawal every week, while Revolut provides a flat rate worldwide.

Yuh vs Neon in comparison?

With our code (not otherwise), Neon also gives you a free card. Both Swiss fintechs offer free cash withdrawals. For transfers abroad, Neon is much cheaper. In return, Yuh convinces with investment accounts. Both providers have savings targets since Neon Spaces.

What is the general Yuh rating and what are the experiences?

The overall Yuh rating is good and positive. Users appreciate the user-friendliness and the comprehensive functions. Yuh experiences show that many praise the ease of use and low fees.

What are the Yuh share fees and the Yuh crypto fees?

Yuh share fees are 0.5% per transaction. Yuh crypto fees are 1.0% per transaction. Both fee structures are competitive compared to other providers.

What is the Yuh Account experience and how reliable is Yuh Bank Switzerland?

The Yuh account experiences are predominantly positive. Users report a reliable and secure online bank throughout Switzerland. The Yuh Bank Switzerland experience confirms the high security standards and reliable support from Swissquote and PostFinance.

What offers are there for Yuh for children and what does the Yuh youth account offer?

Yuh will soon be offering a special Yuh youth account designed for young users. It will include all basic banking functions. Yuh for kids is a good option for families who want to encourage early financial literacy.

How does the Yuh share register work?

Unfortunately, the Yuh share register is not yet available. It is also not yet known whether the function for entries in the share register will be developed in the future.

Are there any known Yuh app issues?

Some users have occasionally reported Yuh App issues, but overall the experience has been stable and reliable.

Are you sure?

Yuh itself is not a bank – all banking services are provided by Swissquote Bank Ltd, which is regulated by FINMA. Your deposits are protected up to CHF 100,000, and securities are considered special assets.

Important to know: In 2024/2025, there were several phishing attacks on Yuh customers. In September 2025, Kassensturz reported on cases in which customers lost sums of money, some of which ran into five figures. According to its terms and conditions, Yuh accepts no liability for unauthorised access.

Protect yourself: never click on links in emails, and never share your Yuh Key or SMS codes. Yuh Apple Pay, Google Pay and TWINT are securely integrated into the app.

About the author

Eric is the founder of Schwiizerfranke.com and certified IAF wealth advisor. Since 2019, he has been helping Swiss citizens to organise their finances comprehensibly, independently and efficiently.

📌 Note: This article is for information purposes only and does not constitute personalised investment advice.

Where can I get this free tax statement? I can't generate it without incurring costs (CHF 25).

Kind regards

Anré

Yes, this new Yuh eTax tax statement unfortunately still costs CHF 25 at the moment, but hopefully it will soon be free of charge. The eTax statement (is basically a PDF that you just have to upload with your tax return and everything is automatically recorded) is worthwhile if you have made a VERY large number of trades etc. Otherwise you can do without it if necessary.

Hello Eric

I'm following your tip with the Core-Sattelite strategy. Core is in ETFs with True Wealth, and I have just opened a Yuh account for Sattelites. The interface is clearly laid out.

But I was surprised that you can only buy a small selection of shares. Especially when you study the various financial blogs and websites, it would be nice to be able to buy less well-known CH shares.

Yuh has its own investment portfolios, but they cost over 1% per year. True Wealth seems to me to be more favourable for investing in ETFs.

I also think it's a shame that you can't set stop limits when buying shares. I would like to see automation so that I can automatically buy a stock when it falls below a limit. So I would say that Yuh is less suitable for active trading. But for me as a beginner, it's probably a case of "back and forth empties your pockets" anyway.

Hello Klaus,

Thanks for your feedback! Absolutely, "back and forth empties the pockets", that's why I stick to passive investing with ETFs.

Yuh offers quite a good selection here. Ultimately, however, Yuh is a platform for beginners and belongs to Swissquote and Postfinance. Swissquote will therefore always remain the more "professional" platform with more features and more products etc.

Hello, I have a pillar 3a account with YUH with the Feurig strategy and I would be interested to know how quickly a change of strategy is implemented for pillar 3a. I have only found the information that the change takes place on Thursday. Does this mean that if the stock markets crash, you have to wait until Thursday and then switch to the daily prices of the following Thursday?

In the 3a, such active trading should be avoided - after all, your investment horizon is usually very long.

A long-term strategy should take centre stage.

All in all, a good bank for trading with a user-friendly app.

I've been with Swissquote for 10 years - but as a normal investor, Yuh's offering is sufficient for me, and the essential functions are also available.

But you also have many advantages.

+ Free credit card with multiple currencies

+ No custody account fees

+ Sufficient investment offer

+ Competitive interest rates on cash

+ Clear app without a lot of bells and whistles

Disadvantages

- High exchange fees (0.95%)

App certainly still has room for improvement (performance display missing, for example)

With the code at the opening you will receive free cryptos (Swisscoins)

Hi Eric, thanks for your interesting blog. I already have NEON and am very happy with it. Now I've also opened a Yuh account and wanted to enter the code YUHFRANKE. The app simply skipped it. I couldn't enter the code anywhere and the support chat insists that you can only use the code during the opening process. Do you have a tip for this or are we both now looking down the tube?

Hello Pete,

Thank you for your positive feedback on the blog! 🙂

It's a pity that it didn't work with Yuh when you opened it. I can ask if there's anything I can do to get it credited anyway.

Kind regards,

Eric

Hello everybody

It says that if you have a growing or larger portfolio, it is better to switch directly to Swissquot, for example. my question now is how do you define large? What amount are we talking about here? 10,000 or 100,000? You also say that it is better to buy in larger amounts, but not so often, from 500 and more because of the fees, which I find a lot as an inexperienced person in this area. Are there any things to bear in mind when investing so much money where?

Hello Maurice

There is definitely a lot to consider. It is therefore essential that you "invest" some time in your financial education before you invest large sums of money. Here you will find a first guide, or feel free to come to the next FinanceTimetable Course.