Revolut Switzerland experience 2026

In the digital age, you're blown away by new apps, banking start-ups and other services. Like the Revolut experience how high the Revolut fees and what the alternatives are, you will find out in this article.

Feel free to leave your feedback in the comments!

Table of contents

Revolut Switzerland - No longer as favourable as it used to be

Many years ago, the company from the United Kingdom caused a small revolution in the Swiss financial market. High security functions and Low costs were at the top of the online bank's list. Revolut offers you with their credit card up to 150 currencies at extremely favourable exchange rates an.

Unfortunately, Revolut has raised the fees for the Swiss in recent years. A Revolut fee for Charging the Debit card from 1,15% and whole 1.5% for topping up a credit cardwhich issued in Switzerland was introduced.

Since then, Revolut has no longer been so interesting for the Swiss. In a wallet, the card can still make sense as a supplement when travelling, but fortunately there are a few, better Swiss online banks with extremely low exchange rates!

Revolut Switzerland Advantages

- Free EURO IBAN account with deposit protection

- In up to 150 currencies at interbank rate Spending money possible

- Currency exchange in 30-Fiat currencies up to 6000€/month without hidden fees

- Free cash withdrawals at all ATMs up to 200€ per month

- In the app adjustable security levels and functions

- Location based security adjustable (if a withdrawal is made in a location other than the location of your mobile phone, you will be warned - has proven helpful abroad in credit card fraud)

- About 8 million satisfied customers

- Transparent costs when making payments

- Intuitive app with many useful functions

- Video-Ident for account opening

- Paperless environmentally friendly Processing

- Global support

- Fast online account opening

- Free credit card with good conditions for payments in foreign currencies

- High safety standards

Revolut disadvantages and criticism

This Revolut experience report not only shows you the advantages, but also the disadvantages of Revolut.

- Pay Revolut cards from Switzerland Top-up fees of up to 1.5%! Since its introduction at the end of 2022, Revolut is no longer attractive for the Swiss. There are now more attractive Swiss online banks.

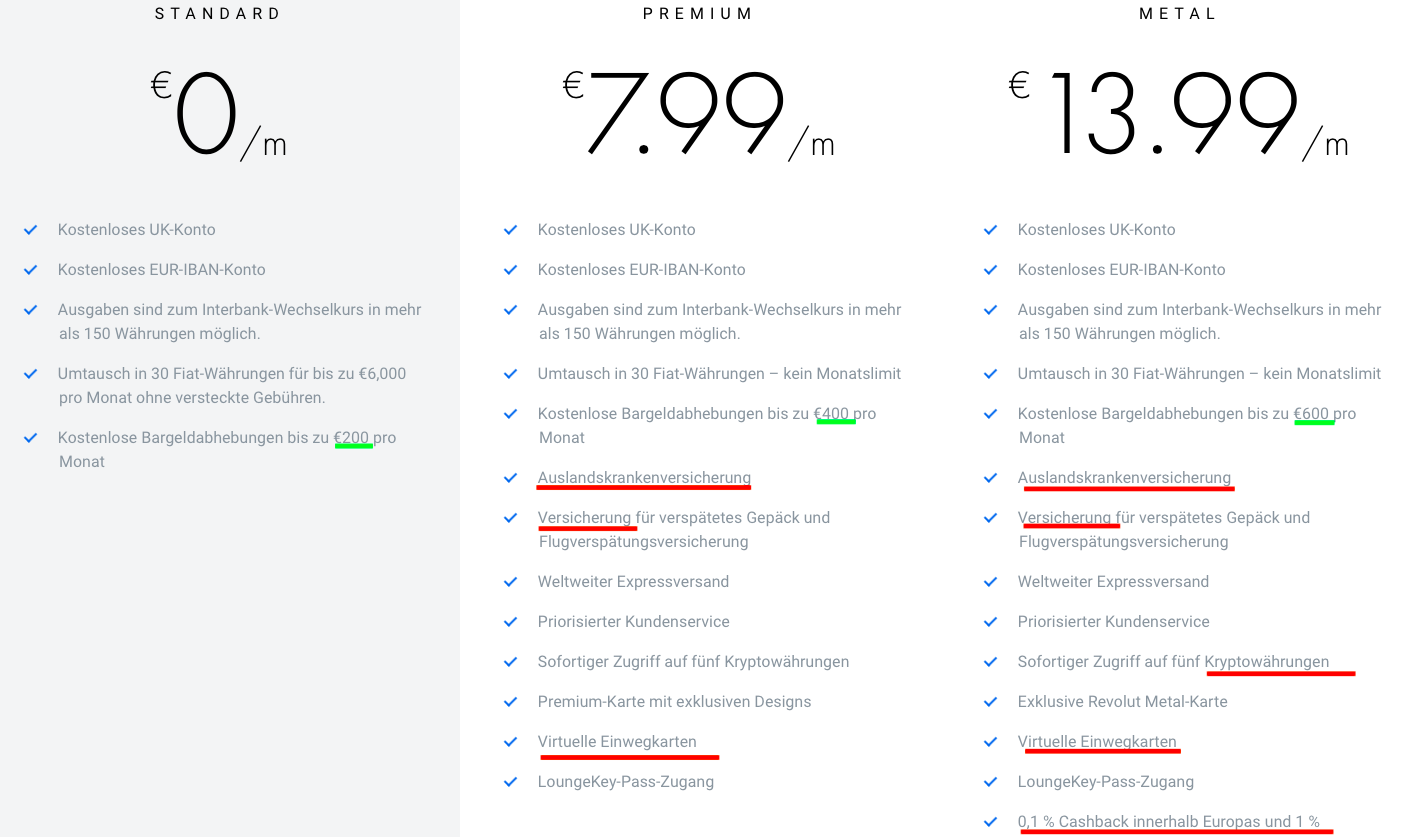

- The fee limit of 200€ (or €400 or €600 for the fee-paying cards) may be a thorn in some people's side.

- Cash withdrawals cost 2% in fees!

- None yet Partner card/account available. So if you want to have a card for a second person on your account, you can't do that.

- Revolut fees may be an issue, but since the bank is not from Switzerland, there are also no twin.

For many Swiss, the Revolut experience not ideal throughout Switzerland - the card is more ideal for Swiss people abroad. A sensible alternative including TWINT and also ideal conditions abroad would be, for example Neon. Here you will find our online bank comparison for Swiss.

Revolut Switzerland Fees

The Revolut fees Switzerland-wide are of course a hot topic, because that is exactly what the provider wants to score points with. There are three different Revolut cost modelswhich also go hand in hand with other maps (see picture below).

In practice, this looks like this: after downloading the app, any (small) amount is transferred to the opened account. Subsequently, the free standard card, or a premium, or metal card can be ordered.

With the Premium card you can choose the colour of the card and with the Metal version you can even order a high-quality aluminium card in different colours. It's nice to have in your wallet, but whether the associated features will improve your Revolut experience is something you'll have to see for yourself.

If you want to avoid fees with Revolut, you can of course intuitively use the standard card. But for example a International Health Insurance or virtual disposable cards (applicable for dubious places of payment) make sense especially abroad.

But if you have the free revolute card the fees behave as follows:

- Basic fee Card and account management: Free of charge

- Withdrawals at any cash machine: Up to 200€ per month free of charge (or equivalent of 200€ for other currencies in other countries)

- Withdrawals over 200€/month: cost 2% fee. If you need this regularly, we recommend upgrading to Premium (400€ free of charge) or Metal (600€ free of charge).

- Transfer in foreign currencies: Free of charge up to 200€ limit per month, afterwards 0,5%

Revolut cryptocurrencies experience

Revolut started in banking with a simple account solution and continues to evolve into the broad-based financial platform.

For some time now, you have also been able to experience Crypto Revolut and directly Buy cryptocurrencies in the app. These are mostly kept in secure offline storage (so-called cold wallets).

Access to cryptocurrencies is particularly easy with such in-app offers. However, you should bear in mind that a specialised crypto exchange has a specialised offer. Security, scope of various cryptocurrencies or about the Tax statement for your tax return are issues you should consider.

For your first contact with blockchain assets, however, you can safely gain experience with Revolut cryptocurrencies.

Free eBook: Your Investment Guide 2026!

In the Wealth Letter you get:

- ✓ 3 specific financial tips every week (3 min reading time)

- ✓ Exclusive financial tips & strategies for the practice

- ✓ Instant bonus: 19-page investment eBook for free (value: CHF 29)

Over 7,000 subscribers are already benefiting. 100% Added value. 0% Spam. Unsubscribe at any time.

Conclusion of the Revolut experience report and review

You've probably already read it in the blog post: Revolut is only conditionally recommendable for Swiss people! Transparency in fees, high security standards and functions as well as an app with many useful functions and, above all, very many interbank exchange rates are certainly exciting.

However, functions within Switzerland, such as a link with TWINT, will probably remain wishful thinking.

Our conclusion: Instead of Revolut, the card from Neon much better for Swiss people. If you travel a lot and would like to have a second card for security, you can always take a closer look at Revolut.

What do you think of Revolut!? Feel free to leave your opinion in the comments.

Revolut Alternative Switzerland

Do you prefer a Swiss bank, would you like to top up your account via Twint and do you prefer to spend your money in the Swiss Franconian area? Then NEON the right thing for you!

Wise now also offers a credit card. Less than a bank, but an excellent option for people who travel a lot! Currently unbeatable in combination with NEON. If you prefer to have just one card, we recommend Revolut. Find out more about Transferwise.

Absolute disaster!!!!!! Been chatting for 4½ hours and no result in sight. Was my first and last transaction.

Thank you for your feedback – unfortunately, you are not alone. The support provided by many foreign providers often leaves much to be desired. Personally, I therefore prefer Swiss online banks.

The great thing about Revolut is the one-way card, a new card number is generated with every payment, the best security for online payments.

This is a great function that some banks now have, such as listed here in the article.

If you read this linked article, you will realise that only Revolut offers virtual disposable cards.

Hello

According to my research, there is no international health insurance cover for Revolut customers resident in Switzerland.

I've been using a Revolut Premium account for a few years now. It used to be an account with the bank in the UK for people resident in Switzerland. Since 2025 it has been an account with Revolut Bank UAB in Lithuania. My deposits to my own account are made free of charge in CHF to an account in the name of Revolut Bank at Postfinance in Switzerland. The amount is then credited to my personal account at Revolut Bank UAB in CHF. I will not be charged a fee for these deposits.

I use the Revolut debit card as my main card in Switzerland, the EU and the USA. I've never had any problems with the account or the card and I'm very happy with it.

2 points of criticism: I also need a real credit card for car hire. As far as I know: No benefits such as international health insurance etc. for customers resident in Switzerland

Dear Eric

Thank you so much - your blog is always so helpful 🎁

We will be travelling for a year and I am of course interested in the "international health insurance" that is included with Revolut ... But what exactly is covered? Unfortunately, I can't find anything about it on the Revolut website ... Do you, does anyone here, have any idea?

Or perhaps the question should rather be: Who offers the best international health insurance on the market?

Kind regards

Daniel

Dear Daniel

I'd love to take a look at them. If I find a good one, I'll add it to the post!

Thank you for the informative portal.

It seems that Revolut has made numerous changes due to the Swiss branch, e.g: Swiss IBAN.

an update on what all this means/entails would be interesting at best

Hello, Peter,

Nothing has changed for me personally so far - my Revolut account is still running without CH-IBAN etc. ... but I'm also curious to see whether the new Revolut office in Zurich will soon bring real improvements for customers.

My son was supposed to transfer Philippine pesos to the Philippine Land Bank (one of the oldest and biggest banks there). He changed francs to PHP (exchange fees) and sent it off (sending fee). The payout to the philipp. Landbank was not possible, only a payout to a phil. Credit card would have been possible (high extra fees). He therefore had it sent back to him. The transfer of his PHP balance on Revolut to a PHP account with Wise was not possible on the part of Revolut. He therefore had to change the pesos back into CHF (exchange fees) and then send CHF to Wise.

Conclusion: Revolut is not suitable for such transactions, it is expensive and cumbersome.

I would not recommend Revolut for international transfers.

Thanks for your input Gerhard.

Personally, I always use Wise for this, the solution is in Neon integrated and works great!

Revolut has now introduced a penalty fee of 1% for standard users who exceed the "fair use" monthly limit of 1,250.

Without a subscription (naturally self-renewing and cancelled 10 months ago with an undefined additional fee), the price structure is extremely opaque. When changing or transferring at the weekend, it also becomes "something" more expensive.

If Wise hadn't still blocked the major crypto exchanges, I would have left long ago. I now only use it as an emergency alternative. I don't recommend buying crypto at all. The fees easily add up to 3% and more.

Wise is unbeatable for transfers and exchanges.

That's right, Revolut is no longer really attractive for the Swiss. A good Revolut alternative for the Swiss is certainly Neon.