neon savings plan templates in the test:

How the new neon ETF templates simplify investing

An end to the ETF agony of choice: the innovative digital bank neon now brings Ready-made savings plan templates directly in your banking app. Instead of fighting your way through 70+ ETFs, simply select "cautious", "balanced" or "ambitious" - and your diversified portfolio is ready.

I was able to test the new savings plan templates in advance and show you why this could be exactly the missing piece of the puzzle for your investment entry. You'll find out all about the convenient ETF templates and the surprisingly high sustainability ETFs.

Table of contents

Switzerland's investment paradox

Only 38% of the Swiss invest in ETFs (Source), even though these are among the most cost-efficient investment instruments. The reason? "I don't know which ETFs to choose" - this sentence comes up in practically every conversation with newcomers from my community. While we are arguing about fee differences of 0.1%, thousands are already failing at the stock selection stage.

This is exactly where neon with a clever idea: ETF savings plan templates. Instead of 70+ ETFs to choose from, there are three ready-made ETF portfolios. Full stop. Done. Invest.

What exactly are the neon ETF savings plan templates?

The concept in 60 seconds

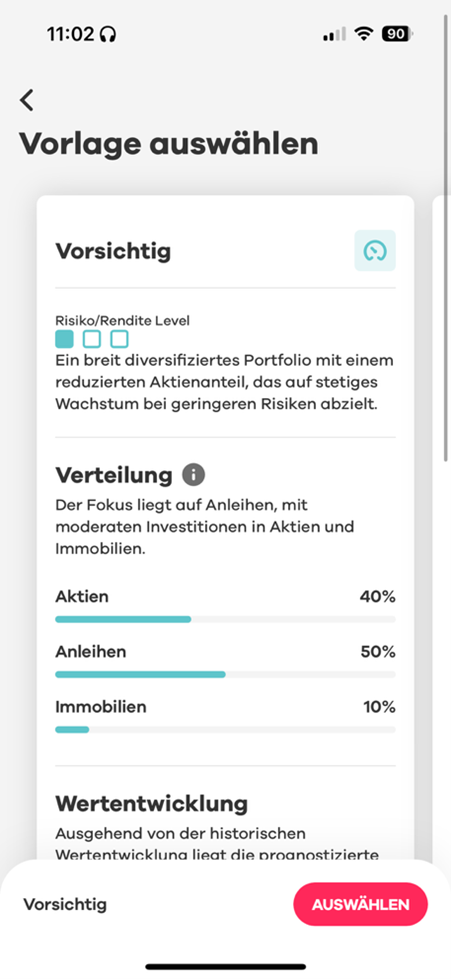

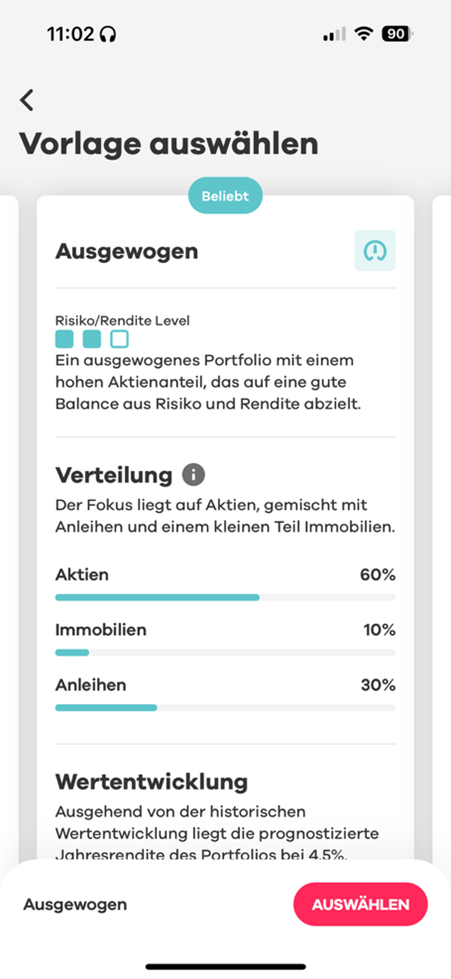

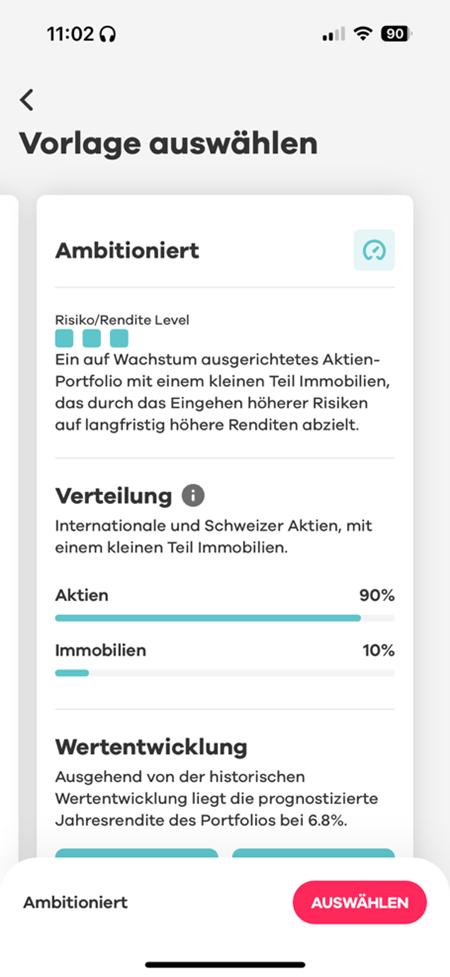

The neon ETF savings plan now offers three portfolio templates:

- Careful40% Shares, 50% Bonds, 10% Real estate

- Balanced60% Shares, 30% Bonds, 10% Real estate

- Ambitious90% Shares, 10% Real estate

Each template can be personalised with two options:

- Switzerland focus60% instead of 10% Swiss shares

- SustainabilityESG ETFs instead of standard ETFs

The highlight: one-click diversification

Instead of laboriously researching individual ETFs, you select a template and customise it as required. The system automatically buys the appropriate ETFs in the correct ratio. This brings robo-advisor functions directly into a traditional banking app - only that you still retain full control.

neon ETF savings plan templates tested in practice

Setup: Surprisingly well thought out

I was able to preview the new templates during the beta phase and analyse the balanced portfolio with CHF 500 per month. The set-up process takes about 3 minutes:

- Template "Balanced" selected

- Option "Switzerland focus" activated

- Savings rate and execution date fixed

- Ready

The result: a portfolio of 4 ETFs (international equity ETF, SPI, bond ETF, property ETF) with the selected weightings.

The ETF selection: Proven and popular

International sharesInvesco FTSE All-World (0.15% TER) Swiss shares: UBS SPI (0.10% TER) BondsUBS Corporate Bonds CHF (0.10% TER) Real EstateUBS Real Estate CHF (0.97% TER)

The selection is well thought out and includes the most popular ETFs on the Swiss market. The FTSE All-World, for example, is one of the best-selling international ETFs. All securities are tried and tested and cost-effective (with the exception of property).

The Swiss focus: more than nostalgia for home

Why 60% Swiss equities can make sense

Many experts preach the diversification bible: "Never more than 5% in your home market!" The reality is different:

Fees for currency exchangeFor CHF 1,000 international shares, you often pay CHF 15-30 exchange rate fees with other brokers. With neon: CHF 0.

Tax optimisationSwiss dividends are exempt from withholding tax, international dividends are not.

Behavioural FinanceYou understand Nestlé, Roche and Novartis better than Chinese tech giants.

The data speaks for itself

Historical performance showsThe SPI has repeatedly outperformed the MSCI World in recent years - especially in phases when the Swiss franc was strong and the dollar weak. Large Swiss asset managers have therefore long pursued a certain domestic focus.

A certain Swiss bias was therefore not only defensive, but often also profitable.

Sustainability: Swisscanto brings SDG power

The ESG revolution at neon

If you choose the sustainability option, you exchange neon the equity ETFs vs. Swisscanto ESGeneration SDG ETFs. These are not run-of-the-mill ESG funds, but a new generation of sustainable ETFs focussing on the UN Development Goals.

What makes Swisscanto ETFs special?

Four-stage selection process:

- Exclusion of problematic industries (weapons, tobacco, fossil fuels)

- Companies with poor sustainability ratings out

- Focus on "SDG Leaders" (companies that promote UN goals)

- Favouring climate-friendly companies

The resultSignificantly stricter criteria than standard ESG ETFs, but without any suspicion of greenwashing.

Performance reality check

An often-heard myth: "Sustainable ETFs cost returns." The initial data of the Swisscanto ESGeneration Switzerland ETF speaks a different language:

Performance since launch (2 April 2025):

- Swisscanto ESGen Switzerland: +4.47%

- SPI: -0.36%

Admittedly, three months is statistically irrelevant. But it shows: Sustainability does not have to mean sacrificing returns.

Cost check: Where neon shines

The truth about fees

ETF purchases in the savings plan:

- Swiss ETFs: 0.5% (min. CHF 1)

- International ETFs: 1.0% (min. CHF 1)

- Exception12 partner ETFs at 0% fees

Further fees:

- Custody fees: CHF 0 ✅

- Currency exchange: CHF 0 ✅

Stamp duty: 0.075%/0.15% (as with all Swiss providers)

Comparison with the competition

| Provider | Savings plan fee | Deposit fee | Currency exchange | Special feature |

|---|---|---|---|---|

| neon | 0.5%/1.0% | CHF 0 | CHF 0 | Templates + 0% Partner ETFs |

| Yuh | 0.5% | CHF 0 | 0.95% | Multi-currency + crypto trading |

| Saxo | 0% | CHF 0 | 0.25% | 100+ ETFs free of charge |

Conclusion: neon is unbeatably favourable for small savings rates, especially with the 0% ETFs.

What works - and what could be better

The highlights

- Ingeniously simple: From the idea to the finished portfolio in 3 minutes

- Sophisticated defaults: The templates are reasonably constructed

- Switzerland option: Clever solution for currency risk and home bias

- Genuine sustainabilitySwisscanto ETFs are stricter than standard ETFs

- Fair costs: Unrivalled, especially for 0% partner ETFs

- SimulationYou see the historical performance of the created portfolio

What could be better

- Limited flexibilityOnly 3 templates,

- Savings plan limitMaximum 6

- Property ETF expensive0.97% TER is steep

- No rebalancing: Weightings drift apart

- Switzerland weighting too extreme60% Switzerland with focus is almost a bit much, 10% without focus rather too little - a 40% option would have been more suitable for my taste. But that's my personal assessment.

Who are the neon ETF savings plan templates ideal for?

The perfect neon investor

- Beginner without ETF experience

- Comfortable, who have no desire for research

- Savers with medium amounts (CHF 100-1,000/month)

- Switzerland fans with a conscious focus on home

- Sustainability investors without greenwashing tolerance

When other solutions are better

For large amounts over CHF 2,000 per monthSaxo, for example, can be cheaper (except for neon's 0% partner ETFs, which may be time-limited) and offers the greater product choice that is usually necessary for customised portfolio construction.

For specialised strategiesSector ETFs, country focus or complex allocations go beyond the 3 templates, which would have to be integrated into neon with additional, specially created savings plans.

Schwiizerfranke's conclusion: An important step

The neon ETF savings plan templates solve a real problemThe excessive demands of ETF selection. While the financial sector loses itself in fee wars, the ETF industry neon investing is becoming increasingly accessible.

The concept is convincing: instead of getting lost in the mass of ETFs, newcomers are provided with three well thought-out portfolios. The Switzerland option intelligently takes into account the needs of domestic investors, while the Swisscanto sustainability option shows that ESG can be more than just greenwashing. Is everything perfect? Not quite - the flexibility has its limits and some decisions are debatable. But this is also where the strength lies: less choice means less confusion.

Ready for your first ETF savings plan? The neon templates are waiting for you in the app. Start now with CHF 100 credit with neon!

My recommendation

For beginners, this is a valuable tool for building up a solid, diversified portfolio without expert knowledge. The neon savings plan templates are a reasonable starting point - Here you learn how portfolios behave without getting lost in the details. Even the historical performance can be considered. If you want to pursue more complex strategies later, you can always switch to brokers with a larger selection or use neon as a basic building block and supplement it elsewhere. Sustainability-conscious investors will find the Swisscanto option to be one of the most convincing ESG approaches on the Swiss market.

The true value lies not in perfection, but in the first stepBetter a simple portfolio than none at all.

Transparency notice: This article was written in paid co-operation with neon. All tests and reviews reflect my honest opinion.

Frequently asked questions about the neon savings plan templates

Can I change the templates at a later date?

Yes, at any time. You can switch between templates or add individual titles of your choice to your templates.

What happens with low savings instalments?

neon buys entire ETF units. At CHF 100/month, it is possible that not all ETFs will be purchased each month. neon recommends an amount of CHF 350 so that all assets can be purchased each month.

Can I also buy individual ETFs?

Yes, the templates complement the normal neon invest range.

How often do you rebalance?

No automatic portfolio rebalancing between the ETFs. Rebalancing only takes place within the individual ETFs. Portfolio rebalancing must be done manually.

About the author

Eric is the founder of Schwiizerfranke.com and certified IAF wealth advisor. Since 2019, he has been helping Swiss citizens to organise their finances comprehensibly, independently and efficiently.

📌 Note: This article is for information purposes only and does not constitute personalised investment advice.

An intermediate solution between a robo-advisor and doing everything yourself. Very helpful for beginners.

Almost too easy - dangerous for beginners? On the other hand, you then have a broad line-up and not just individual stocks ...